Resume Examples

January 20, 2025

13 Private Equity Resume Examples

by Sam WrightInvest in your career growth with these private equity resume examples.

Build a resume for freeWhether you're an aspiring analyst or a seasoned principal, your resume needs to showcase your financial acumen, deal-making prowess, and ability to drive value. This comprehensive guide offers expert insights and private equity resume examples to help you land your dream job in this lucrative field. Learn how to highlight your achievements, quantify your impact, and present your skills in a way that resonates with top firms. Let's dive into these private equity resumes and learn how to write a resume that opens doors to exciting opportunities.

Build your private equity resume today

Use our AI Resume Builder, Interview Prep and Job Search Tools to land your next job.

Private Equity Resume Examples

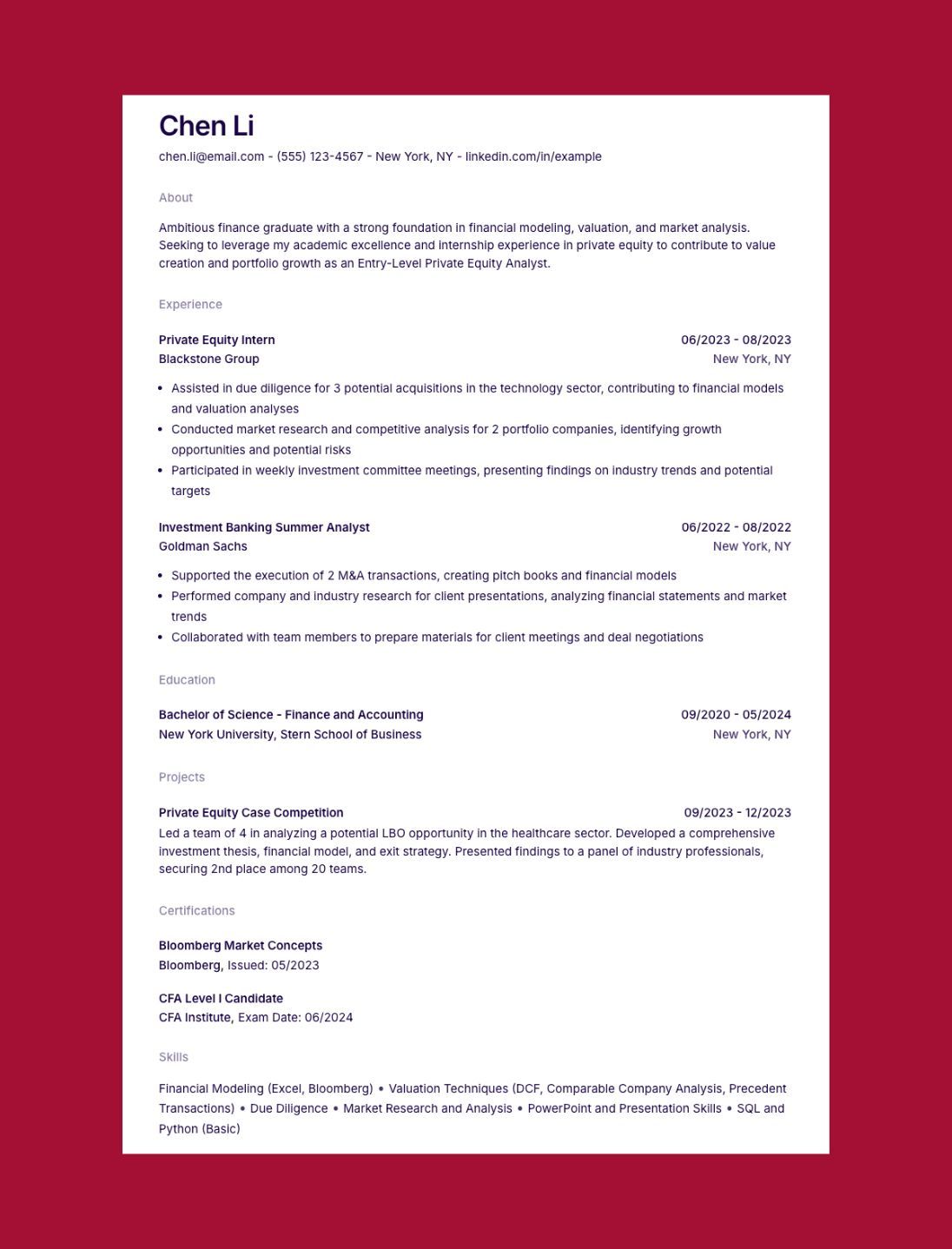

Entry-Level Private Equity Analyst Resume

For those just starting their private equity career, this entry-level analyst resume example showcases how to leverage internships, academic achievements, and relevant projects to make a strong impression.

Build Your Entry-Level Private Equity Analyst ResumeChen Li

[email protected] - (555) 123-4567 - New York, NY - linkedin.com/in/example

About

Ambitious finance graduate with a strong foundation in financial modeling, valuation, and market analysis. Seeking to leverage my academic excellence and internship experience in private equity to contribute to value creation and portfolio growth as an Entry-Level Private Equity Analyst.

Experience

Private Equity Intern

Blackstone Group

06/2023 - 08/2023

New York, NY

- Assisted in due diligence for 3 potential acquisitions in the technology sector, contributing to financial models and valuation analyses

- Conducted market research and competitive analysis for 2 portfolio companies, identifying growth opportunities and potential risks

- Participated in weekly investment committee meetings, presenting findings on industry trends and potential targets

Investment Banking Summer Analyst

Goldman Sachs

06/2022 - 08/2022

New York, NY

- Supported the execution of 2 M&A transactions, creating pitch books and financial models

- Performed company and industry research for client presentations, analyzing financial statements and market trends

- Collaborated with team members to prepare materials for client meetings and deal negotiations

Education

Bachelor of Science - Finance and Accounting

New York University, Stern School of Business

09/2020 - 05/2024

New York, NY

Projects

Private Equity Case Competition

09/2023 - 12/2023

Led a team of 4 in analyzing a potential LBO opportunity in the healthcare sector. Developed a comprehensive investment thesis, financial model, and exit strategy. Presented findings to a panel of industry professionals, securing 2nd place among 20 teams.

Certifications

Bloomberg Market Concepts

CFA Level I Candidate

Skills

Financial Modeling (Excel, Bloomberg) • Valuation Techniques (DCF, Comparable Company Analysis, Precedent Transactions) • Due Diligence • Market Research and Analysis • PowerPoint and Presentation Skills • SQL and Python (Basic)

Why this resume is great

This entry-level private equity analyst resume effectively showcases the candidate's potential despite limited work experience. The strong academic background and relevant internships demonstrate a solid foundation in finance. The resume highlights specific achievements and quantifiable results, such as assisting with due diligence for three potential acquisitions and participating in two M&A transactions. The inclusion of a case competition project further illustrates the candidate's ability to apply theoretical knowledge to real-world scenarios, making them an attractive prospect for private equity firms.

Senior Private Equity Associate Resume

This senior private equity associate resume example demonstrates how to highlight deal experience, financial expertise, and leadership skills gained over several years in the industry.

Build Your Senior Private Equity Associate ResumeNikola Rossi

[email protected] - (555) 987-6543 - Chicago, IL - linkedin.com/in/example

About

Seasoned private equity professional with 5+ years of experience in deal sourcing, execution, and portfolio management. Proven track record of driving value creation and successful exits across various industries. Seeking to leverage my expertise in financial analysis, due diligence, and stakeholder management to contribute to a leading private equity firm's growth and success.

Experience

Senior Private Equity Associate

Advent International

07/2020 - Present

Chicago, IL

- Led due diligence and financial modeling for 6 successful investments totaling $1.2B in enterprise value across technology and healthcare sectors

- Managed 4 portfolio companies, implementing operational improvements that increased EBITDA by an average of 25% within 2 years

- Sourced and evaluated 50+ potential investment opportunities, presenting 10 to the investment committee

- Mentored 3 junior associates, providing guidance on financial modeling and deal execution

Private Equity Associate

Bain Capital

07/2018 - 06/2020

Boston, MA

- Participated in the execution of 4 buyout transactions with a combined value of $800M in the consumer goods and retail sectors

- Developed comprehensive financial models and sensitivity analyses for investment opportunities

- Conducted industry research and competitive analysis to support investment theses and value creation plans

- Assisted in the preparation of investment committee materials and quarterly reports for limited partners

Investment Banking Analyst

Morgan Stanley

07/2016 - 06/2018

New York, NY

- Supported the execution of 10+ M&A and capital markets transactions across various industries

- Created detailed financial models, valuation analyses, and pitch books for client presentations

- Performed industry and company research to identify potential acquisition targets and investment opportunities

Education

Master of Business Administration - Finance Concentration

University of Chicago, Booth School of Business

09/2018 - 05/2020

Chicago, IL

- GPA: 3.8/4.0

Bachelor of Science - Economics

Yale University

09/2012 - 05/2016

New Haven, CT

- GPA: 3.7/4.0

Certifications

Chartered Financial Analyst (CFA)

Skills

Advanced Financial Modeling and Valuation • Due Diligence and Deal Execution • Portfolio Management and Value Creation • Industry and Market Analysis • Stakeholder Management • Leadership and Mentoring • Advanced Excel, PowerPoint, and Financial Databases (Capital IQ, FactSet)

Why this resume is great

This senior private equity associate resume effectively showcases the candidate's progression and accomplishments in the industry. The experience section highlights specific achievements, such as leading due diligence for $1.2B in investments and managing portfolio companies with significant EBITDA improvements. The resume demonstrates a strong track record in deal sourcing, execution, and value creation, which are crucial for a senior role. The inclusion of mentoring experience and advanced certifications like the CFA further enhances the candidate's profile, making them an attractive prospect for leadership positions in private equity firms.

Private Equity Vice President Resume

For those advancing to leadership roles, this private equity vice president resume example illustrates how to emphasize deal leadership, value creation strategies, and team management skills.

Build Your Private Equity Vice President ResumeHugo Bernard

[email protected] - +44 20 1234 5678 - London, UK - linkedin.com/in/example

About

Dynamic private equity professional with 10+ years of experience in deal origination, execution, and portfolio management. Proven track record of leading high-value transactions and driving exceptional returns across multiple sectors. Seeking to leverage my strategic vision, financial acumen, and leadership skills to excel as a Vice President in a top-tier private equity firm.

Experience

Vice President

KKR

01/2019 - Present

London, UK

- Led 5 successful buyout transactions with a total enterprise value of €3.5B across technology, healthcare, and industrial sectors

- Managed a team of 6 associates and analysts, overseeing deal execution, due diligence, and portfolio management activities

- Developed and implemented value creation strategies for 7 portfolio companies, resulting in an average IRR of 25% and 2.5x multiple on invested capital

- Originated and cultivated relationships with key industry executives, investment bankers, and advisors, generating a robust deal pipeline

- Presented investment opportunities to the investment committee and communicated regularly with limited partners

Senior Associate

Apax Partners

06/2015 - 12/2018

London, UK

- Executed 4 mid-market buyout transactions with a combined enterprise value of €1.2B in the technology and business services sectors

- Led financial modeling, due diligence, and negotiations for acquisitions and exits

- Worked closely with portfolio company management teams to develop and implement strategic initiatives, resulting in significant value creation

- Mentored junior team members and participated in the firm's recruitment and training programs

Investment Banking Associate

J.P. Morgan

07/2012 - 05/2015

London, UK

- Advised on 12+ M&A and capital markets transactions across various industries in EMEA

- Developed complex financial models, valuation analyses, and presentation materials for client pitches and deal execution

- Coordinated due diligence processes and managed relationships with clients, legal counsel, and other advisors

Education

Master of Business Administration

INSEAD

09/2011 - 06/2012

Fontainebleau, France

Bachelor of Science - Economics and Mathematics

London School of Economics

09/2007 - 06/2011

London, UK

- First Class Honours

Certifications

Chartered Financial Analyst (CFA)

Skills

Deal Origination and Execution • Strategic Planning and Value Creation • Financial Modeling and Valuation • Due Diligence and Negotiations • Team Leadership and Mentoring • Stakeholder Management • Industry and Market Analysis

Why this resume is great

This private equity vice president resume effectively demonstrates the candidate's progression to a leadership role in the industry. The experience section highlights significant achievements, such as leading €3.5B in buyout transactions and managing a team of 6 professionals. The resume showcases a strong track record in deal origination, execution, and value creation, with impressive metrics like a 25% average IRR for portfolio companies. The candidate's ability to cultivate relationships, present to investment committees, and communicate with limited partners is clearly emphasized, making them an ideal candidate for a vice president position in a top-tier private equity firm.

Private Equity Principal Resume

This private equity principal resume example showcases how to highlight extensive deal experience, strategic leadership, and a proven track record of value creation across multiple investments.

Build Your Private Equity Principal ResumeJames Martinez

[email protected] - (555) 234-5678 - San Francisco, CA - linkedin.com/in/example

About

Seasoned private equity professional with 15+ years of experience in deal sourcing, execution, and portfolio management. Proven track record of driving exceptional returns and creating value across diverse industries. Seeking to leverage my strategic vision, extensive network, and leadership skills to contribute to the continued success of a leading private equity firm as a Principal.

Experience

Principal

Thoma Bravo

03/2016 - Present

San Francisco, CA

- Led 8 platform investments and 12 add-on acquisitions with a total enterprise value of $4.5B in the software and technology services sectors

- Developed and executed value creation plans for 10 portfolio companies, resulting in an average EBITDA growth of 35% and 3.2x multiple on invested capital

- Managed successful exits of 5 portfolio companies, generating an average IRR of 40% and 4.5x return on invested capital

- Built and led cross-functional deal teams, overseeing all aspects of the investment lifecycle from sourcing to exit

- Cultivated and maintained relationships with C-level executives, investment bankers, and industry experts to generate proprietary deal flow

- Served on the board of directors for 6 portfolio companies, providing strategic guidance and oversight

Vice President

Silver Lake Partners

01/2011 - 02/2016

New York, NY

- Executed 6 large-cap technology buyouts with a combined enterprise value of $7B

- Led due diligence, financial modeling, and negotiations for complex transactions

- Worked closely with portfolio company management teams to implement operational improvements and growth initiatives

- Mentored and managed a team of associates and analysts, fostering their professional development

Associate

Bain Capital

07/2007 - 12/2010

Boston, MA

- Participated in the execution of 5 mid-market buyout transactions across various industries

- Conducted financial analysis, market research, and due diligence for potential investments

- Assisted in the development of value creation plans and monitoring of portfolio company performance

Education

Master of Business Administration

Harvard Business School

09/2005 - 05/2007

Boston, MA

- Baker Scholar (Top 5% of class)

Bachelor of Science - Computer Science and Economics

Stanford University

09/2001 - 06/2005

Stanford, CA

- Summa Cum Laude

Certifications

Chartered Financial Analyst (CFA)

Skills

Deal Sourcing and Execution • Value Creation Strategy • Financial Modeling and Valuation • Due Diligence and Negotiations • Board-level Management • Team Leadership and Mentoring • Industry and Technology Trends Analysis

Why this resume is great

This private equity principal resume effectively showcases the candidate's extensive experience and impressive track record in the industry. The resume highlights significant achievements, such as leading $4.5B in platform investments and generating a 40% average IRR on exits. The candidate's ability to create value across multiple portfolio companies is clearly demonstrated, with metrics like 35% average EBITDA growth. The resume also emphasizes leadership skills, including board-level management and team development. The combination of technical expertise, strategic vision, and proven results makes this candidate an excellent fit for a principal role in a top-tier private equity firm.

Private Equity Managing Director Resume

For senior executives, this private equity managing director resume example demonstrates how to showcase industry leadership, fund performance, and strategic vision for driving firm growth.

Build Your Private Equity Managing Director ResumeMatias Sanchez

[email protected] - (555) 345-6789 - New York, NY - linkedin.com/in/example

About

Accomplished private equity executive with 20+ years of experience in investment strategy, deal execution, and firm leadership. Proven track record of generating superior returns, building high-performing teams, and driving firm growth. Seeking to leverage my extensive network, strategic vision, and operational expertise to lead investment activities and contribute to the continued success of a premier private equity firm as Managing Director.

Experience

Managing Director

Carlyle Group

01/2012 - Present

New York, NY

- Led the firm's North American technology and business services practice, overseeing a $5B investment portfolio

- Spearheaded 12 platform investments and 20+ add-on acquisitions with a total enterprise value of $15B

- Achieved top-quartile fund performance with a 32% gross IRR and 3.8x multiple on invested capital across realized investments

- Developed and executed value creation strategies for portfolio companies, resulting in an average EBITDA growth of 45% during holding periods

- Built and mentored a team of 15 investment professionals, fostering a culture of excellence and collaboration

- Served on the firm's investment committee, evaluating and approving all North American buyout investments

- Cultivated relationships with limited partners, participating in fundraising efforts that raised over $10B in capital commitments

Partner

Warburg Pincus

06/2005 - 12/2011

New York, NY

- Led 8 control investments in the technology and financial services sectors with a combined enterprise value of $6B

- Developed and implemented operational improvement initiatives across portfolio companies, driving significant value creation

- Served on the board of directors for 7 portfolio companies, providing strategic guidance and governance oversight

- Played a key role in the firm's expansion into emerging markets, establishing new office locations and investment strategies

Vice President

Blackstone Group

07/1999 - 05/2005

New York, NY

- Executed 6 large-cap buyout transactions across various industries

- Led due diligence, financial modeling, and negotiations for complex transactions

- Worked closely with portfolio company management teams to implement growth initiatives and operational improvements

Education

Master of Business Administration

Wharton School, University of Pennsylvania

09/1997 - 05/1999

Philadelphia, PA

- Palmer Scholar (Top 5% of class)

Bachelor of Arts - Economics

Princeton University

09/1993 - 06/1997

Princeton, NJ

- Magna Cum Laude

Certifications

Chartered Financial Analyst (CFA)

Skills

Investment Strategy and Execution • Fund Management and Performance • Value Creation and Operational Improvement • Team Leadership and Talent Development • Board-level Management and Governance • Limited Partner Relations and Fundraising • Global Market and Industry Analysis

Why this resume is great

This private equity managing director resume effectively showcases the candidate's exceptional leadership and investment track record. The resume highlights impressive achievements, such as overseeing a $5B portfolio and generating a 32% gross IRR. The candidate's ability to drive firm growth, mentor teams, and cultivate relationships with limited partners is clearly demonstrated. The resume also emphasizes strategic vision and operational expertise, making the candidate an ideal fit for a senior leadership role in a top-tier private equity firm. The progression from Vice President to Managing Director illustrates a consistent career trajectory and increasing responsibilities in the industry.

Buyout-Focused Private Equity Resume

This buyout-focused private equity resume example illustrates how to emphasize deal execution skills, value creation strategies, and industry expertise specific to leveraged buyouts.

Build Your Buyout-Focused Private Equity ResumeAmelia Anderson

[email protected] - (555) 456-7890 - Boston, MA - linkedin.com/in/example

About

Results-driven private equity professional with 8+ years of experience specializing in middle-market buyouts. Proven track record in deal sourcing, execution, and value creation across various industries. Seeking to leverage my expertise in financial analysis, operational improvement, and stakeholder management to drive superior returns in a buyout-focused private equity role.

Experience

Vice President

Summit Partners

06/2018 - Present

Boston, MA

- Led 5 successful leveraged buyout transactions with a total enterprise value of $1.2B across technology, healthcare, and business services sectors

- Developed and implemented value creation plans for 7 portfolio companies, resulting in an average EBITDA growth of 30% and 2.8x multiple on invested capital

- Sourced and evaluated 100+ potential investment opportunities, presenting 15 to the investment committee

- Managed a team of 4 associates and analysts, overseeing due diligence, financial modeling, and portfolio monitoring activities

- Served on the board of directors for 3 portfolio companies, providing strategic guidance and operational oversight

Senior Associate

H.I.G. Capital

07/2015 - 05/2018

Miami, FL

- Executed 4 middle-market buyout transactions with a combined enterprise value of $600M in the industrial and consumer goods sectors

- Conducted comprehensive due diligence, financial modeling, and sensitivity analyses for potential investments

- Worked closely with portfolio company management teams to identify and implement operational improvements and growth initiatives

- Assisted in the successful exit of 2 portfolio companies, generating an average IRR of 35%

Investment Banking Associate

Goldman Sachs

07/2012 - 06/2015

New York, NY

- Advised on 10+ M&A and leveraged finance transactions across various industries

- Developed detailed financial models, valuation analyses, and presentation materials for client pitches and deal execution

- Coordinated due diligence processes and managed relationships with clients, legal counsel, and other advisors

Education

Master of Business Administration

Harvard Business School

09/2010 - 05/2012

Boston, MA

Bachelor of Science - Finance and Accounting

University of Pennsylvania, Wharton School

09/2006 - 05/2010

Philadelphia, PA

- Summa Cum Laude

Certifications

Chartered Financial Analyst (CFA)

Skills

Leveraged Buyout Analysis and Execution • Financial Modeling and Valuation • Due Diligence and Deal Structuring • Value Creation Strategy • Operational Improvement • Stakeholder Management • Industry and Market Analysis

Why this resume is great

This buyout-focused private equity resume effectively showcases the candidate's expertise in middle-market leveraged buyouts. The experience section highlights significant achievements, such as leading $1.2B in buyout transactions and driving 30% average EBITDA growth in portfolio companies. The resume demonstrates a strong track record in deal sourcing, execution, and value creation, which are crucial for buyout-focused roles. The inclusion of board experience and team management skills further enhances the candidate's profile. The progression from investment banking to private equity, coupled with an MBA from a top institution, makes this candidate an attractive prospect for senior roles in buyout-focused private equity firms.

Growth Equity Resume

This growth equity resume example showcases how to highlight expertise in identifying high-growth companies, supporting rapid expansion, and driving value through strategic guidance rather than operational control.

Build Your Growth Equity ResumeLucia Perez

[email protected] - (555) 567-8901 - San Francisco, CA - linkedin.com/in/example

About

Dynamic growth equity investor with 7+ years of experience in identifying and scaling high-potential companies across technology and consumer sectors. Proven track record in deal sourcing, due diligence, and value creation through strategic guidance and capital deployment. Seeking to leverage my expertise in growth-stage investing to drive exceptional returns and support innovative companies in their next phase of expansion.

Experience

Principal

General Atlantic

08/2019 - Present

San Francisco, CA

- Led 6 growth equity investments totaling $450M in enterprise SaaS, fintech, and consumer technology companies

- Developed and executed value creation strategies for 8 portfolio companies, resulting in an average revenue CAGR of 75% and 3.5x multiple on invested capital

- Sourced and evaluated 150+ potential investment opportunities, presenting 20 to the investment committee

- Served as board observer for 4 portfolio companies, providing strategic guidance on product development, go-to-market strategies, and talent acquisition

- Mentored a team of 3 associates, fostering their professional development and deal execution skills

Senior Associate

Insight Partners

06/2016 - 07/2019

New York, NY

- Executed 5 growth equity investments with a combined value of $200M in B2B software and internet companies

- Conducted comprehensive due diligence, financial modeling, and market analysis for potential investments

- Worked closely with portfolio company management teams to develop KPI dashboards, optimize SaaS metrics, and implement best practices

- Assisted in the successful exit of 3 portfolio companies through strategic sales and IPOs, generating an average IRR of 40%

Technology Investment Banking Analyst

Morgan Stanley

07/2014 - 05/2016

San Francisco, CA

- Advised on 8+ M&A and capital raising transactions for high-growth technology companies

- Developed detailed financial models, valuation analyses, and presentation materials for client pitches and deal execution

- Performed industry research and competitive analysis to support investment theses and strategic recommendations

Education

Master of Business Administration

Stanford Graduate School of Business

09/2018 - 06/2020

Stanford, CA

- Arjay Miller Scholar (Top 10% of class)

Bachelor of Science - Computer Science

University of California, Berkeley

09/2010 - 05/2014

Berkeley, CA

- Highest Honors

Projects

Tech Startup Accelerator Mentor

01/2021 - Present

Advise early-stage startups on product-market fit, go-to-market strategies, and fundraising. Conducted workshops on financial modeling and pitch deck creation for cohort members.

Certifications

Chartered Financial Analyst (CFA)

Skills

Growth Equity Investment Analysis • SaaS Metrics and Unit Economics • Financial Modeling and Valuation • Due Diligence and Market Research • Strategic Planning and Scaling • Board Advisory and Governance • Technology Trend Analysis

Why this resume is great

This growth equity resume effectively demonstrates the candidate's expertise in identifying and scaling high-growth companies. The experience section highlights impressive achievements, such as leading $450M in investments and driving a 75% average revenue CAGR for portfolio companies. The resume showcases a strong understanding of SaaS metrics, strategic guidance, and value creation in growth-stage companies. The inclusion of board observer experience and mentoring roles enhances the candidate's profile. The combination of technology background, MBA from a top institution, and progression from investment banking to growth equity makes this candidate an ideal fit for senior roles in growth equity firms focusing on technology and consumer sectors.

Venture Capital Resume

This venture capital resume example illustrates how to highlight expertise in early-stage investing, startup ecosystem knowledge, and the ability to support founders through various growth stages.

Build Your Venture Capital ResumeValentina Rodrigues

[email protected] - (555) 678-9012 - Palo Alto, CA - linkedin.com/in/example

About

Visionary venture capital investor with 6+ years of experience in early-stage technology investments. Proven track record in identifying disruptive startups, supporting founder growth, and driving portfolio value. Seeking to leverage my deep tech expertise, extensive network, and operational experience to fuel innovation and generate exceptional returns in a leading venture capital firm.

Experience

Partner

Andreessen Horowitz

01/2020 - Present

Menlo Park, CA

- Led 10 early-stage investments totaling $80M across AI/ML, blockchain, and enterprise software sectors

- Sourced and evaluated 300+ startups annually, presenting 25 to the investment committee

- Developed and implemented value-add programs for portfolio companies, including talent acquisition, go-to-market strategy, and fundraising support

- Served on the board of directors for 5 portfolio companies, providing strategic guidance and governance oversight

- Achieved 2 successful exits through acquisitions, generating a 5x and 8x return on invested capital respectively

- Mentored 15+ founders, helping them navigate product-market fit, team building, and scaling challenges

Senior Associate

Sequoia Capital

06/2017 - 12/2019

Menlo Park, CA

- Executed 8 seed and Series A investments with a combined value of $40M in consumer tech and frontier tech startups

- Conducted comprehensive due diligence, market analysis, and financial modeling for potential investments

- Assisted portfolio companies in subsequent fundraising rounds, helping secure $150M+ in follow-on capital

- Organized networking events and workshops for portfolio founders, fostering a collaborative ecosystem

Founder & CEO

TechNova (Acquired)

01/2015 - 05/2017

San Francisco, CA

- Founded and scaled an AI-powered predictive maintenance SaaS platform for manufacturing industries

- Raised $3M in seed funding from top-tier VCs and angel investors

- Grew the team to 15 employees and acquired 20+ enterprise customers before successful acquisition

Software Engineer

07/2012 - 12/2014

Mountain View, CA

- Developed machine learning algorithms for Google's advertising platform, improving ad relevance by 15%

- Collaborated with product managers and UX designers to launch new features for Google AdSense

Education

Master of Business Administration

Stanford Graduate School of Business

09/2015 - 06/2017

Stanford, CA

- Siebel Scholar

Bachelor of Science - Computer Science

Massachusetts Institute of Technology

09/2008 - 05/2012

Cambridge, MA

- Phi Beta Kappa

Projects

AI Ethics Advisory Board Member

03/2022 - Present

Provide guidance on ethical considerations in AI development and deployment for a leading tech company. Contribute to policy recommendations and best practices for responsible AI innovation.

Certifications

Kauffman Fellows Program

Skills

Early-stage Investment Analysis • Technology Trend Forecasting • Due Diligence and Market Research • Startup Ecosystem Navigation • Founder Mentoring and Support • Board Governance • Product Development and Strategy

Why this resume is great

This venture capital resume effectively showcases the candidate's expertise in early-stage technology investments and startup ecosystem knowledge. The experience section highlights impressive achievements, such as leading $80M in investments and achieving successful exits with significant returns. The resume demonstrates a strong understanding of various tech sectors and the ability to add value beyond capital through mentoring and strategic guidance. The candidate's background as a successful founder adds credibility and practical insight into the challenges faced by portfolio companies. The combination of technical expertise, MBA from a top institution, and progression from founder to VC partner makes this candidate an ideal fit for senior roles in technology-focused venture capital firms.

Distressed Debt Private Equity Resume

This distressed debt private equity resume example demonstrates how to highlight expertise in identifying undervalued assets, restructuring strategies, and creating value in challenging market conditions.

Build Your Distressed Debt Private Equity ResumeGiulia Ferrari

[email protected] - (555) 789-0123 - New York, NY - linkedin.com/in/example

About

Strategic distressed debt investor with 9+ years of experience in identifying undervalued assets, executing complex restructurings, and generating superior returns in challenging market conditions. Proven track record in credit analysis, negotiation, and value creation across various industries. Seeking to leverage my expertise in distressed investing and turnaround strategies to drive exceptional performance in a leading distressed debt private equity firm.

Experience

Director

Oaktree Capital Management

03/2017 - Present

New York, NY

- Led 12 distressed debt investments totaling $800M across energy, retail, and industrials sectors

- Developed and executed restructuring strategies for 8 portfolio companies, resulting in an average IRR of 28% and 2.5x multiple on invested capital

- Sourced and evaluated 200+ potential investment opportunities, presenting 30 to the investment committee

- Negotiated complex debt purchases, exchange offers, and debt-for-equity swaps, often taking control positions in target companies

- Served on creditors' committees for 5 Chapter 11 bankruptcy cases, influencing reorganization plans and maximizing recoveries

- Managed a team of 4 associates, overseeing financial modeling, due diligence, and portfolio monitoring activities

Vice President

Apollo Global Management

06/2013 - 02/2017

New York, NY

- Executed 7 distressed and special situations investments with a combined value of $400M across various industries

- Conducted comprehensive credit analysis, asset valuation, and scenario modeling for potential investments

- Worked closely with portfolio company management teams to implement operational improvements and deleveraging strategies

- Assisted in the successful exit of 4 investments through refinancing and strategic sales, generating an average IRR of 22%

Associate

Lazard Frères & Co.

07/2010 - 05/2013

New York, NY

- Advised on 10+ restructuring and bankruptcy cases for companies with aggregate liabilities exceeding $20B

- Developed detailed financial models, valuation analyses, and presentation materials for client pitches and creditor negotiations

- Assisted in the development of reorganization plans, liquidation analyses, and creditor recovery scenarios

Education

Master of Business Administration

Columbia Business School

09/2008 - 05/2010

New York, NY

- Dean's List

Bachelor of Science - Finance and Economics

New York University, Stern School of Business

09/2004 - 05/2008

New York, NY

- Magna Cum Laude

Projects

Guest Lecturer, Distressed Investing

01/2020 - Present

Deliver annual lectures on distressed debt investing strategies and case studies to MBA students. Provide mentorship to students interested in pursuing careers in distressed investing and restructuring.

Certifications

Chartered Financial Analyst (CFA)

Certified Insolvency and Restructuring Advisor (CIRA)

Skills

Distressed Debt Analysis and Valuation • Restructuring and Turnaround Strategies • Bankruptcy Process and Creditors' Rights • Financial Modeling and Scenario Analysis • Negotiation and Deal Structuring • Industry and Market Analysis • Team Leadership and Stakeholder Management

Why this resume is great

This distressed debt private equity resume effectively showcases the candidate's expertise in navigating complex distressed situations and creating value in challenging market conditions. The experience section highlights impressive achievements, suchas leading $800M in distressed debt investments and generating a 28% average IRR. The resume demonstrates a strong understanding of restructuring strategies, bankruptcy processes, and creditors' rights. The inclusion of experience on creditors' committees and in negotiating complex debt transactions enhances the candidate's profile. The progression from restructuring advisory to distressed investing, coupled with relevant certifications like CFA and CIRA, makes this candidate an ideal fit for senior roles in distressed debt private equity firms. The addition of guest lecturing experience showcases thought leadership in the field.

Real Estate Private Equity Resume

This real estate private equity resume example illustrates how to highlight expertise in property acquisitions, asset management, and value-add strategies across various real estate sectors.

Build Your Real Estate Private Equity ResumeOliver Thompson

[email protected] - (555) 890-1234 - Los Angeles, CA - linkedin.com/in/example

About

Seasoned real estate private equity professional with 10+ years of experience in acquisitions, asset management, and value creation across multiple property types. Proven track record of identifying undervalued assets, executing repositioning strategies, and generating superior returns. Seeking to leverage my expertise in real estate investment and portfolio management to drive exceptional performance in a leading real estate private equity firm.

Experience

Principal

Blackstone Real Estate

06/2016 - Present

Los Angeles, CA

- Led 15 real estate investments totaling $2.5B across multifamily, office, industrial, and hospitality sectors

- Developed and executed value-add strategies for 20 properties, resulting in an average IRR of 22% and 2.2x equity multiple

- Sourced and evaluated 100+ potential investment opportunities annually, presenting 25 to the investment committee

- Managed a $1.5B portfolio of assets, overseeing property operations, leasing strategies, and capital improvement projects

- Structured and negotiated complex joint ventures, preferred equity investments, and mezzanine debt transactions

- Led a team of 5 associates and analysts, overseeing financial modeling, due diligence, and asset management activities

Vice President

Starwood Capital Group

07/2012 - 05/2016

Miami, FL

- Executed 10 real estate investments with a combined value of $800M across various property types and geographies

- Conducted comprehensive market research, financial analysis, and due diligence for potential acquisitions

- Implemented asset management strategies for a $600M portfolio, focusing on NOI growth and operational efficiencies

- Assisted in the successful disposition of 8 assets, generating an average IRR of 18% and 1.8x equity multiple

Associate

Morgan Stanley Real Estate Investing

07/2009 - 06/2012

New York, NY

- Participated in the underwriting and execution of $1.2B in real estate investments across the capital stack

- Developed detailed financial models, valuation analyses, and investment committee materials

- Supported asset management teams in monitoring property performance and implementing value creation initiatives

Education

Master of Business Administration

The Wharton School, University of Pennsylvania

09/2007 - 05/2009

Philadelphia, PA

- Palmer Scholar

Bachelor of Science - Real Estate and Finance

University of Southern California

09/2003 - 05/2007

Los Angeles, CA

- Summa Cum Laude

Projects

Urban Redevelopment Task Force Member

01/2019 - Present

Collaborate with city officials and industry leaders to develop strategies for sustainable urban redevelopment. Contribute to policy recommendations for affordable housing initiatives and mixed-use development projects.

Certifications

Chartered Financial Analyst (CFA)

ARGUS Enterprise Certification

Skills

Real Estate Investment Analysis • Financial Modeling and Valuation • Asset Management and Value Creation • Market Research and Due Diligence • Joint Venture Structuring • Capital Markets and Financing • Team Leadership and Stakeholder Management

Why this resume is great

This real estate private equity resume effectively demonstrates the candidate's expertise across various property types and investment strategies. The experience section highlights significant achievements, such as leading $2.5B in real estate investments and generating a 22% average IRR. The resume showcases a strong understanding of value-add strategies, asset management, and complex deal structuring. The progression from Morgan Stanley to Blackstone, coupled with an MBA from a top institution, makes this candidate an attractive prospect for senior roles in real estate private equity firms. The inclusion of urban redevelopment task force experience adds depth to the candidate's profile, showcasing broader industry engagement and thought leadership.

Infrastructure Private Equity Resume

This infrastructure private equity resume example showcases expertise in long-term capital deployment, public-private partnerships, and value creation in regulated asset classes.

Build Your Infrastructure Private Equity ResumeNoor Al-Farsi

[email protected] - +44 20 7123 4567 - London, UK - linkedin.com/in/example

About

Strategic infrastructure investor with 12+ years of experience in acquiring, managing, and optimizing essential assets across energy, transportation, and utilities sectors. Proven track record in structuring complex transactions, navigating regulatory environments, and driving long-term value creation. Seeking to leverage my expertise in infrastructure investing and stakeholder management to lead investment activities in a premier infrastructure private equity firm.

Experience

Director

Global Infrastructure Partners

09/2015 - Present

London, UK

- Led 8 infrastructure investments totaling €3.5B across renewable energy, ports, and water treatment sectors

- Developed and executed value creation strategies for 10 portfolio assets, resulting in an average IRR of 15% and 1.8x equity multiple

- Sourced and evaluated 50+ potential investment opportunities annually, presenting 15 to the investment committee

- Structured and negotiated complex public-private partnerships (PPPs) and concession agreements with government entities

- Managed a €2B portfolio of infrastructure assets, focusing on operational improvements, capital structure optimization, and ESG initiatives

- Led a team of 6 investment professionals, overseeing financial modeling, due diligence, and asset management activities

Vice President

Macquarie Infrastructure and Real Assets

07/2011 - 08/2015

New York, NY

- Executed 6 infrastructure investments with a combined value of $1.5B across transportation and energy sectors

- Conducted comprehensive due diligence, financial modeling, and regulatory analysis for potential acquisitions

- Implemented asset management strategies for a $1B portfolio, focusing on operational efficiencies and growth initiatives

- Assisted in the successful refinancing and partial exit of 3 portfolio companies, generating an average IRR of 12%

Associate

Credit Suisse Infrastructure Partners

07/2008 - 06/2011

London, UK

- Participated in the underwriting and execution of €800M in infrastructure investments across Europe and North America

- Developed detailed financial models, valuation analyses, and investment committee materials

- Supported asset management teams in monitoring asset performance and regulatory compliance

Education

Master of Science - Infrastructure Investment and Finance

University College London

09/2007 - 08/2008

London, UK

- Distinction

Bachelor of Science - Civil Engineering

Imperial College London

09/2003 - 06/2007

London, UK

- First Class Honours

Projects

Sustainable Infrastructure Working Group Member

03/2020 - Present

Collaborate with industry peers to develop frameworks for assessing climate risks and opportunities in infrastructure investments. Contribute to policy recommendations for promoting sustainable infrastructure development and energy transition.

Certifications

Chartered Financial Analyst (CFA)

Certified PPP Professional (CP3P)

Skills

Infrastructure Investment Analysis • Financial Modeling and Valuation • Asset Management and Optimization • Regulatory Analysis and Compliance • Public-Private Partnerships (PPPs) • ESG Integration and Reporting • Stakeholder Management and Negotiation

Why this resume is great

This infrastructure private equity resume effectively showcases the candidate's expertise in essential asset classes and long-term value creation strategies. The experience section highlights impressive achievements, such as leading €3.5B in infrastructure investments and structuring complex public-private partnerships. The resume demonstrates a strong understanding of regulatory environments, operational improvements, and ESG initiatives crucial for infrastructure investing. The progression from Credit Suisse to Global Infrastructure Partners, coupled with relevant certifications and education, makes this candidate an ideal fit for senior roles in infrastructure private equity firms. The inclusion of sustainable infrastructure working group experience adds depth to the candidate's profile, showcasing thought leadership in addressing climate-related challenges in the sector.

Private Equity Operations Resume

This private equity operations resume example illustrates how to highlight expertise in implementing operational improvements, driving value creation, and supporting portfolio company growth across multiple industries.

Build Your Private Equity Operations ResumeSara Tanaka

[email protected] - (555) 234-5678 - Boston, MA - linkedin.com/in/example

About

Results-driven private equity operations professional with 10+ years of experience in implementing value creation initiatives and operational improvements across diverse industries. Proven track record of collaborating with management teams to drive EBITDA growth, optimize processes, and execute successful exit strategies. Seeking to leverage my expertise in operational excellence and strategic planning to maximize portfolio company performance in a leading private equity firm.

Experience

Operating Partner

Bain Capital

04/2017 - Present

Boston, MA

- Led value creation initiatives for 12 portfolio companies across technology, healthcare, and industrial sectors, resulting in an average EBITDA improvement of 35% within 24 months

- Developed and implemented 100-day plans for 8 newly acquired companies, focusing on quick wins and long-term strategic initiatives

- Spearheaded digital transformation projects for 5 portfolio companies, driving revenue growth through e-commerce expansion and data analytics implementation

- Conducted operational due diligence for 20+ potential acquisitions, identifying value creation opportunities and operational risks

- Mentored and coached C-suite executives of portfolio companies, aligning incentives and driving cultural change

- Led a team of 4 operating professionals, overseeing project management and performance tracking across the portfolio

Director of Operations

TPG Capital

06/2013 - 03/2017

San Francisco, CA

- Executed operational improvement strategies for 6 portfolio companies in the retail and consumer goods sectors

- Implemented lean manufacturing principles and supply chain optimization initiatives, resulting in 20% average cost reduction

- Led post-merger integration efforts for 3 add-on acquisitions, achieving synergy targets ahead of schedule

- Developed KPI dashboards and performance tracking systems to monitor operational improvements across the portfolio

Management Consultant

McKinsey & Company

07/2009 - 05/2013

Chicago, IL

- Advised Fortune 500 clients on operational excellence, cost reduction, and growth strategies across multiple industries

- Led teams of 3-5 consultants in executing complex transformation projects, consistently delivering ahead of schedule and under budget

Education

Master of Business Administration

Harvard Business School

09/2007 - 05/2009

Boston, MA

- Baker Scholar

Bachelor of Science - Industrial Engineering

Massachusetts Institute of Technology

09/2003 - 05/2007

Cambridge, MA

- Phi Beta Kappa

Projects

Industry 4.0 Advisory Board Member

01/2020 - Present

Provide guidance on the adoption of advanced manufacturing technologies and digital transformation strategies. Contribute to best practice sharing and thought leadership in operational excellence for the manufacturing sector.

Certifications

Lean Six Sigma Black Belt

Certified Management Consultant (CMC)

Skills

Operational Due Diligence • Value Creation Strategy • Process Optimization • Digital Transformation • Supply Chain Management • Performance Metrics and KPI Tracking • Change Management and Leadership

Why this resume is great

This private equity operations resume effectively demonstrates the candidate's expertise in driving operational improvements and value creation across diverse industries. The experience section highlights significant achievements, such as leading initiatives resulting in a 35% average EBITDA improvement and successfully implementing digital transformation projects. The resume showcases a strong understanding of operational due diligence, 100-day planning, and post-merger integration, which are crucial for private equity operations roles. The progression from management consulting to operating partner, coupled with an MBA from a top institution and relevant certifications, makes this candidate an ideal fit for senior operational roles in private equity firms. The inclusion of Industry 4.0 advisory board experience adds depth to the candidate's profile, showcasing thought leadership in advanced manufacturing technologies.

Private Equity Investor Relations Resume

This private equity investor relations resume example showcases expertise in fundraising, limited partner communications, and managing stakeholder relationships in the private equity ecosystem.

Build Your Private Equity Investor Relations ResumeEmma Larsson

[email protected] - (555) 345-6789 - New York, NY - linkedin.com/in/example

About

Accomplished private equity investor relations professional with 8+ years of experience in fundraising, limited partner communications, and stakeholder management. Proven track record of successfully raising capital, cultivating investor relationships, and enhancing firm visibility in the global private equity landscape. Seeking to leverage my expertise in investor relations and strategic communications to drive fundraising success and strengthen limited partner relationships in a leading private equity firm.

Experience

Director, Investor Relations

KKR

05/2018 - Present

New York, NY

- Led fundraising efforts for 3 flagship funds, raising over $25B in capital commitments from institutional investors, family offices, and high-net-worth individuals

- Developed and executed comprehensive investor relations strategies, resulting in a 30% increase in limited partner satisfaction scores

- Managed relationships with 200+ limited partners globally, providing timely updates on fund performance, investment strategies, and market trends

- Organized and led annual investor meetings, quarterly update calls, and bespoke LP site visits to portfolio companies

- Collaborated with investment teams to create compelling fundraising materials, investment memos, and quarterly reports

- Implemented a new CRM system, improving efficiency in investor communications and relationship tracking by 40%

Vice President, Investor Relations

Carlyle Group

06/2014 - 04/2018

Washington, D.C.

- Supported fundraising activities for multiple strategies, including buyout, growth, and credit funds, totaling $15B in commitments

- Developed and maintained relationships with 100+ institutional investors, serving as a key point of contact for inquiries and due diligence requests

- Created and delivered presentations for potential investors, investment consultants, and industry conferences

- Coordinated with legal and compliance teams to ensure adherence to regulatory requirements in investor communications

Associate, Investor Relations

Blackstone Group

07/2011 - 05/2014

New York, NY

- Assisted in the preparation of quarterly reports, investor presentations, and due diligence materials for various private equity funds

- Supported the organization of annual investor meetings and roadshows across North America and Europe

- Conducted market research and competitive analysis to inform fundraising strategies and investor communications

Education

Master of Business Administration

Columbia Business School

09/2009 - 05/2011

New York, NY

- Dean's List

Bachelor of Arts - Economics and Communication

Stanford University

09/2005 - 06/2009

Stanford, CA

- Magna Cum Laude

Projects

Guest Lecturer, Private Equity Investor Relations

02/2020 - Present

Deliver annual lectures on best practices in private equity investor relations and fundraising strategies to MBA students. Provide mentorship to students interested in pursuing careers in alternative investments and investor relations.

Certifications

Certified Investment Fund Director (CIFD)

Series 7 and 63 Licenses

Skills

Fundraising Strategy and Execution • Investor Relationship Management • Financial Reporting and Analysis • Presentation and Public Speaking • Stakeholder Communications • CRM Systems and Data Management • Regulatory Compliance (SEC, AIFMD)

Why this resume is great

This private equity investor relations resume effectively showcases the candidate's expertise in fundraising and stakeholder management within the private equity ecosystem. The experience section highlights impressive achievements, such as raising over $25B in capital commitments and significantly improving limited partner satisfaction scores. The resume demonstrates a strong understanding of investor communications, fund marketing, and regulatory compliance, which are crucial for investor relations roles in private equity. The progression from Blackstone to KKR, coupled with relevant certifications and licenses, makes this candidate an ideal fit for senior investor relations positions in top-tier private equity firms. The inclusion of guest lecturing experience adds depth to the candidate's profile, showcasing thought leadership and industry engagement.

How to Write a Private Equity Resume

Private Equity Resume Outline

A well-structured private equity resume should include the following sections:

- Contact Information

- Professional Summary or Objective

- Work Experience

- Education

- Skills

- Certifications

- Additional Sections (e.g., Projects, Publications, or Volunteer Work)

This outline ensures that you present all relevant information in a logical and easy-to-read format, allowing hiring managers to quickly assess your qualifications for private equity roles.

Which Resume Layout Should a Private Equity Professional Use?

For private equity professionals, a reverse-chronological resume layout is typically the most effective. This format highlights your most recent and relevant experience first, which is crucial in the fast-paced and competitive private equity industry. Here are some key considerations:

- Use a clean, professional design with ample white space for readability

- Stick to a standard font (e.g., Arial, Calibri, or Times New Roman) in 10-12 point size

- Use bold or italic formatting sparingly to emphasize key information

- Ensure consistent formatting throughout the document

- Keep your resume to one or two pages, depending on your experience level

Remember, private equity firms value efficiency and attention to detail. Your resume's layout should reflect these qualities, making it easy for recruiters to find the information they need quickly.

What Your Private Equity Resume Header Should Include

Your private equity resume header should be concise and professional, providing essential contact information.

Here's what to include in your header:

Michael O'Brien

[email protected] - +44 20 1234 5678 - London, UK - linkedin.com/in/example

Why it works

- Full name in a slightly larger font - City and state of residence (full address not necessary) - Professional email address - Phone number LinkedIn profile URL (ensure it's customized and up-to-date)

Here's what to avoid including in your header:

James Smith

[email protected] - New York, NY - @JSmithPE

Bad example

- Full home address (unnecessary and takes up valuable space) - Unprofessional email address - Social media handles (unless specifically relevant to your professional brand)

What Your Private Equity Resume Summary Should Include

A powerful resume summary can set the tone for your entire application. For private equity professionals, it should concisely highlight your experience, key achievements, and unique value proposition. Here's what to include:

- Years of experience in private equity or relevant fields (e.g., investment banking, consulting)

- Areas of expertise (e.g., LBOs, growth equity, distressed investing)

- Notable achievements (e.g., deal sizes, returns generated, successful exits)

- Relevant skills or certifications

- Your career goals or the value you bring to a potential employer

Keep your summary to 3-4 impactful sentences, focusing on your most impressive qualifications and achievements.

Private Equity Resume Summary Examples

Michael Dill

About

Seasoned private equity professional with 8+ years of experience in middle-market buyouts and growth equity investments. Led 10+ transactions totaling $2B in enterprise value across technology and healthcare sectors. Proven track record of generating superior returns, with an average IRR of 25% on realized investments. Seeking to leverage my deal execution expertise and value creation strategies to drive exceptional performance in a senior role at a leading private equity firm.

Why it works

- Clearly states years of experience and areas of expertise - Highlights specific achievements with quantifiable results - Mentions relevant sectors and investment strategies - Includes a clear objective aligned with the role

Betty Wood

About

Strong analytical skills and attention to detail. Team player with good communication abilities.

Bad example

- Lacks specific information about experience in private equity - No mention of achievements or quantifiable results - Generic skills without context to private equity - Vague objective that doesn't highlight unique value proposition

What Are the Most Common Private Equity Responsibilities?

Understanding the core responsibilities of private equity professionals is crucial for crafting a targeted resume. Common responsibilities include:

- Deal sourcing and origination

- Financial modeling and valuation

- Due diligence and market research

- Deal structuring and negotiation

- Portfolio company management and value creation

- Exit strategy planning and execution

- Investor relations and fundraising support

- Industry and market trend analysis

- Team leadership and mentoring (for more senior roles)

When describing your experience, focus on these key areas and provide specific examples of how you've excelled in these responsibilities.

What Your Private Equity Resume Experience Should Include

Your work experience section is the heart of your private equity resume. Here's what to include for each position:

- Company name, location, and your job title

- Dates of employment (month and year)

- 3-5 bullet points describing your key responsibilities and achievements

- Quantifiable results and specific examples of your impact

- Relevant deals you've worked on, including size and outcomes

- Leadership or mentoring experiences

- Industry specializations or sector expertise

Use action verbs and focus on outcomes rather than just listing duties. Tailor your experience to highlight skills and achievements most relevant to the private equity role you're targeting.

Private Equity Resume Experience Examples

Experience

Associate

XYZ Capital Partners

06/2018 - Present

New York, NY

- Led financial modeling and due diligence for 5 completed transactions totaling $750M in enterprise value across software and healthcare sectors

- Developed and presented investment theses to the investment committee, resulting in the approval of 3 new platform investments

- Implemented value creation initiatives for 2 portfolio companies, driving EBITDA growth of 30% over an 18-month period

- Sourced 50+ potential investment opportunities, conducting initial screenings and presenting 10 to senior leadership

- Mentored 2 junior analysts, providing guidance on financial modeling and industry research techniques

Why it works

- Clearly outlines specific responsibilities and achievements - Includes quantifiable results (e.g., deal sizes, EBITDA growth) - Demonstrates progression of responsibilities (e.g., leading due diligence, presenting to investment committee) - Highlights relevant skills such as financial modeling, deal sourcing, and mentoring

Experience

Private Equity Associate

ABC Investments

2019 - 2021

- Worked on various private equity deals

- Conducted financial analysis and research

- Assisted senior team members with tasks

- Attended meetings and took notes

Bad example

- Lacks specific details about deals or responsibilities - No quantifiable achievements or results - Generic descriptions that don't showcase unique contributions - Fails to demonstrate growth or progression in the role - No location

What's the Best Education for a Private Equity Resume?

Education is crucial in the private equity industry. While there's no single "best" educational path, certain degrees and institutions are highly valued. Here's what to consider:

- Bachelor's degree in finance, economics, accounting, or a related field from a top-tier university

- MBA from a prestigious business school (often preferred for mid to senior-level positions)

- Advanced degrees such as Master's in Finance or CFA can be beneficial

- Relevant coursework in financial modeling, valuation, and corporate finance

- High GPA (typically 3.5 or above)

When listing your education, include the degree, major, university name, graduation year, and any academic honors or relevant coursework. For experienced professionals, education should come after your work experience section.

What's the Best Professional Organization for a Private Equity Resume?

Membership in professional organizations can demonstrate your commitment to the field and provide valuable networking opportunities. Some respected organizations for private equity professionals include:

- Association for Corporate Growth (ACG)

- Institutional Limited Partners Association (ILPA)

- Private Equity CFO Association (PECFOA)

- CFA Institute

- National Venture Capital Association (NVCA)

When listing professional organizations on your resume, include your membership status and any leadership roles or significant contributions you've made within the organization.

What Are the Best Awards for a Private Equity Resume?

Awards and recognitions can set you apart from other candidates. Relevant awards for private equity professionals might include:

- Deal of the Year awards from industry publications (e.g., PE Hub, PitchBook)

- Rising Star recognitions in private equity (e.g., Forbes 30 Under 30 in Finance)

- Top Performer awards from your firm

- Academic awards such as Beta Gamma Sigma for business excellence

- Industry-specific awards related to your sector focus (e.g., healthcare innovation awards)

When listing awards, include the name of the award, the awarding organization, and the year received. Focus on the most prestigious and relevant awards to your private equity career.

What Are Good Volunteer Opportunities for a Private Equity Resume?

Volunteer work can demonstrate leadership, community engagement, and a well-rounded personality. Relevant volunteer opportunities for private equity professionals include:

- Mentoring programs for aspiring finance professionals or underprivileged youth

- Board membership for non-profit organizations, especially in treasurer or finance roles

- Pro bono consulting for small businesses or startups

- Financial literacy programs in local communities

- Involvement in university alumni associations, particularly in fundraising or career development initiatives

When including volunteer work on your resume, focus on leadership roles and quantifiable impacts you've made. This can showcase your ability to drive results outside of your professional role.

What Are the Best Hard Skills to Add to a Private Equity Resume?

Hard skills are crucial in private equity roles. Some of the most valuable hard skills to include on your resume are:

- Financial modeling and valuation

- Due diligence and financial analysis

- LBO modeling

- Advanced Excel and financial software (e.g., Capital IQ, FactSet)

- Financial statement analysis

- Industry and market analysis

- Deal structuring and negotiation

- Portfolio management and value creation strategies

- Data analytics and visualization

- Knowledge of accounting principles and tax considerations

When listing hard skills, be prepared to demonstrate proficiency during interviews or through case studies. Focus on skills that are most relevant to the specific private equity role you're applying for.

What Are the Best Soft Skills to Add to a Private Equity Resume?

While hard skills are essential, soft skills are equally important in private equity, where relationship-building and teamwork are crucial. Key soft skills to highlight include:

- Analytical thinking and problem-solving

- Communication (both written and verbal)

- Negotiation and persuasion

- Leadership and team management

- Attention to detail

- Time management and ability to work under pressure

- Adaptability and quick learning

- Relationship building and networking

- Strategic thinking

- Ethical decision-making

When highlighting soft skills, provide context or examples of how you've demonstrated these skills in your professional experiences. This adds credibility to your claims and shows how you apply these skills in real-world scenarios.

What Are the Best Certifications for a Private Equity Resume?

Certifications can enhance your credibility and demonstrate your commitment to professional development. Some valuable certifications for private equity professionals include:

- Chartered Financial Analyst (CFA)

- Certified Public Accountant (CPA)

- Chartered Alternative Investment Analyst (CAIA)

- Financial Risk Manager (FRM)

- Certified M&A Advisor (CM&AA)

- Private Equity Certificate Program (offered by various institutions)

When listing certifications, include the full name of the certification, the issuing organization, and the date of acquisition or expected completion. Prioritize certifications that are most relevant to your target role in private equity.

Tips for an Effective Private Equity Resume

To create a standout private equity resume, consider the following tips:

- Tailor your resume to the specific role and firm you're applying to

- Quantify your achievements with specific metrics and deal sizes

- Use industry-specific terminology from the job description to demonstrate your knowledge

- Highlight your progression and increasing responsibilities

- Showcase both technical skills and soft skills

- Include relevant coursework or projects if you're early in your career

- Proofread carefully to ensure there are no errors or typos

- Keep the design clean and professional

- Use strong action verbs to describe your experiences

- Consider including a brief interests section to show personality

Remember, your resume is your first impression on potential employers. Make sure it effectively communicates your value proposition and aligns with the requirements of the private equity role you're targeting.

How Long Should I Make My Private Equity Resume?

The ideal length for a private equity resume depends on your experience level. Here are some guidelines:

- Entry-level to 5 years of experience: Stick to a one-page resume

- 5-15 years of experience: One to two pages, focusing on the most relevant and recent experiences

- 15+ years of experience or executive-level: Two pages, potentially three if you have an extensive deal history or leadership experience

Remember, quality trumps quantity. It's better to have a concise, impactful resume than a lengthy one filled with irrelevant information. Focus on your most impressive achievements and experiences that directly relate to the private equity role you're pursuing.

What's the Best Format for a Private Equity Resume?

The best format for a private equity resume is typically a reverse-chronological layout. This format showcases your most recent and relevant experiences first, which is crucial in the fast-paced private equity industry. Here's why it works:

- Highlights career progression and increasing responsibilities

- Allows hiring managers to quickly assess your recent achievements

- Aligns with Applicant Tracking Systems (ATS) preferences

- Provides a clear and logical flow of information

While the reverse-chronological format is generally preferred, ensure your resume is tailored to highlight your most relevant experiences for the specific private equity role you're targeting.

What Should the Focus of a Private Equity Resume Be?

The focus of a private equity resume should be on demonstrating your ability to create value and generate returns. Key areas to emphasize include:

- Deal experience: Highlight the number, size, and types of deals you've worked on

- Financial acumen: Showcase your skills in financial modeling, valuation, and analysis

- Industry expertise: Emphasize your knowledge of specific sectors or investment strategies

- Value creation: Describe how you've contributed to portfolio company growth or successful exits

- Leadership and teamwork: Demonstrate your ability to lead deals, manage teams, or mentor junior staff

- Track record: Quantify your achievements with metrics like IRR, multiple on invested capital, or EBITDA growth

Remember to tailor your resume to the specific requirements of the role and firm you're applying to. Research the firm's investment strategy and focus areas to align your experiences and skills accordingly.

Conclusion

Crafting a compelling private equity resume requires a strategic approach that highlights your unique value proposition, deal experience, and ability to generate returns. By following the guidelines and examples provided in this comprehensive guide, you'll be well-equipped to create a resume that stands out in the competitive private equity landscape. Remember to continually update your resume as you gain new experiences and achievements, and always tailor it to the specific opportunity you're pursuing.

With a well-crafted resume, you'll be one step closer to landing your dream role in private equity.

Ready to take your job search to the next level?

Sign-up for Huntr and streamline your application process today.

Get More Interviews, Faster

Huntr streamlines your job search. Instantly craft tailored resumes and cover letters, fill out application forms with a single click, effortlessly keep your job hunt organized, and much more...

AI Resume Builder

Beautiful, perfectly job-tailored resumes designed to make you stand out, built 10x faster with the power of AI.

Next-Generation Job Tailored Resumes

Huntr provides the most advanced job <> resume matching system in the world. Helping you match not only keywords, but responsibilities and qualifications from a job, into your resume.

Job Keyword Extractor + Resume AI Integration

Huntr extracts keywords from job descriptions and helps you integrate them into your resume using the power of AI.

Application Autofill

Save hours of mindless form filling. Use our chrome extension to fill application forms with a single click.

Job Tracker

Move beyond basic, bare-bones job trackers. Elevate your search with Huntr's all-in-one, feature-rich management platform.

AI Cover Letters

Perfectly tailored cover letters, in seconds! Our cover letter generator blends your unique background with the job's specific requirements, resulting in unique, standout cover letters.

Resume Checker

Huntr checks your resume for spelling, length, impactful use of metrics, repetition and more, ensuring your resume gets noticed by employers.

Gorgeous Resume Templates

Stand out with one of 7 designer-grade templates. Whether you're a creative spirit or a corporate professional, our range of templates caters to every career aspiration.

Personal Job Search CRM

The ultimate companion for managing your professional job-search contacts and organizing your job search outreach.