Resume Examples

December 08, 2024

15 Underwriter Resume Examples

by Rennie HaylockDe-risk your job search with these underwriter resume examples.

Build a resume for freeThis comprehensive guide offers a variety of underwriter resume examples and expert tips to help you craft a standout application. Learn how to highlight your strengths, tailor your resume to specific underwriting roles, and increase your chances of landing your dream job in the underwriting field.

Build your underwriter resume today

Use our AI Resume Builder, Interview Prep and Job Search Tools to land your next job.

Underwriter Resume Examples

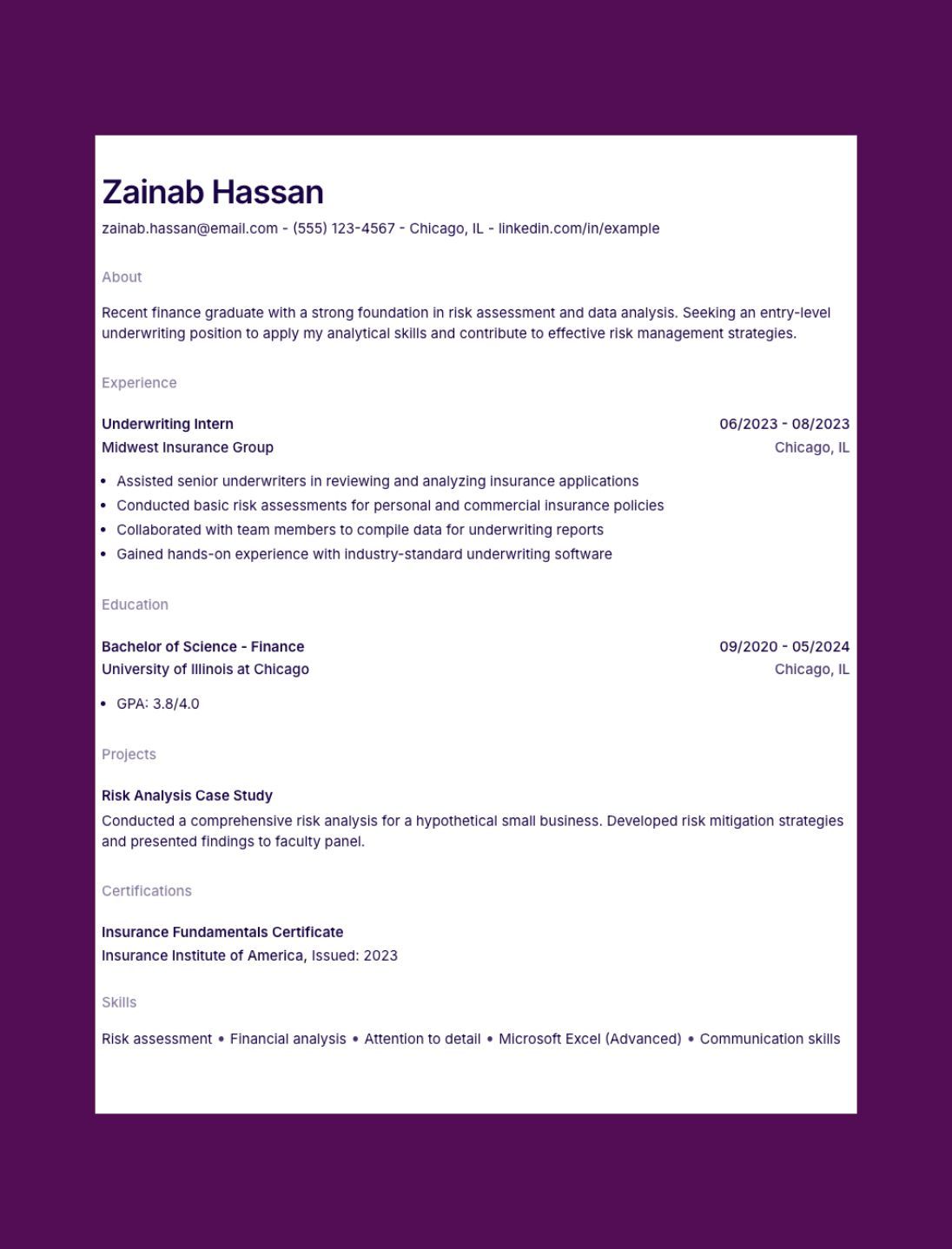

Entry-Level Underwriter Resume

An entry-level underwriter resume example showcases relevant education, internships, and analytical skills to compensate for limited professional experience.

Build Your Entry-Level Underwriter ResumeZainab Hassan

[email protected] - (555) 123-4567 - Chicago, IL - linkedin.com/in/example

About

Recent finance graduate with a strong foundation in risk assessment and data analysis. Seeking an entry-level underwriting position to apply my analytical skills and contribute to effective risk management strategies.

Experience

Underwriting Intern

Midwest Insurance Group

06/2023 - 08/2023

Chicago, IL

- Assisted senior underwriters in reviewing and analyzing insurance applications

- Conducted basic risk assessments for personal and commercial insurance policies

- Collaborated with team members to compile data for underwriting reports

- Gained hands-on experience with industry-standard underwriting software

Education

Bachelor of Science - Finance

University of Illinois at Chicago

09/2020 - 05/2024

Chicago, IL

- GPA: 3.8/4.0

Projects

Risk Analysis Case Study

Conducted a comprehensive risk analysis for a hypothetical small business. Developed risk mitigation strategies and presented findings to faculty panel.

Certifications

Insurance Fundamentals Certificate

Skills

Risk assessment • Financial analysis • Attention to detail • Microsoft Excel (Advanced) • Communication skills

Why this resume is great

This entry-level underwriter resume effectively showcases the candidate's potential despite limited professional experience. The strong educational background in finance, coupled with relevant coursework, demonstrates a solid foundation in underwriting principles. The internship experience highlights practical skills gained in the field, while the projects section showcases the ability to apply theoretical knowledge to real-world scenarios. The inclusion of relevant certifications and technical skills further strengthens the resume, making it an attractive option for employers seeking fresh talent in the underwriting field.

Mid-Level Insurance Underwriter Resume

A mid-level insurance underwriter resume example demonstrates a track record of successful risk assessments and policy decisions across various insurance types.

Build Your Mid-Level Insurance Underwriter ResumeSophie Johnson

[email protected] - (555) 987-6543 - Boston, MA - linkedin.com/in/example

About

Dedicated insurance underwriter with 5 years of experience in property and casualty insurance. Proven track record of accurate risk assessment and policy decisions. Seeking to leverage my expertise in a challenging mid-level underwriting role.

Experience

Senior Underwriter

New England Insurance Co.

07/2021 - Present

Boston, MA

- Evaluate complex insurance applications for commercial property and liability coverage

- Conduct in-depth risk analyses and determine appropriate premium rates

- Collaborate with agents and brokers to negotiate policy terms and conditions

- Mentor junior underwriters and contribute to team training initiatives

- Achieved a 15% increase in policy retention rate through improved risk assessment techniques

Underwriter

Boston Bay Insurance

06/2019 - 06/2021

Boston, MA

- Assessed and underwrote personal and small commercial insurance policies

- Analyzed financial statements, loss history, and industry trends to make informed underwriting decisions

- Developed and maintained relationships with insurance agents and brokers

- Consistently met or exceeded monthly underwriting targets

Education

Bachelor of Business Administration - Risk Management and Insurance

Boston University

09/2015 - 05/2019

Boston, MA

Certifications

Chartered Property Casualty Underwriter (CPCU)

Associate in Commercial Underwriting (AU)

Skills

Advanced risk assessment • Policy analysis and development • Negotiation and communication • Underwriting software proficiency • Team leadership and mentoring

Why this resume is great

This mid-level insurance underwriter resume effectively showcases the candidate's progression and expertise in the field. The professional experience section highlights key responsibilities and quantifiable achievements, demonstrating the ability to handle complex underwriting tasks and contribute to team success. The inclusion of relevant certifications and professional associations underscores the candidate's commitment to ongoing professional development. The skills section effectively balances technical underwriting abilities with soft skills like leadership and communication, making this resume appealing to employers seeking experienced underwriters who can take on additional responsibilities.

Senior Mortgage Underwriter Resume

A senior mortgage underwriter resume example highlights extensive experience in evaluating complex loan applications and managing high-value portfolios.

Build Your Senior Mortgage Underwriter ResumeWei Zhang

[email protected] - (555) 234-5678 - San Francisco, CA - linkedin.com/in/example

About

Results-driven senior mortgage underwriter with 10+ years of experience in evaluating complex loan applications and managing high-value portfolios. Expertise in risk assessment, regulatory compliance, and process improvement. Seeking a leadership role to drive underwriting excellence and strategic growth.

Experience

Lead Mortgage Underwriter

Pacific Coast Lending

08/2018 - Present

San Francisco, CA

- Oversee a team of 5 underwriters, ensuring consistent application of underwriting guidelines and regulatory compliance

- Evaluate and approve high-value and complex mortgage applications, including jumbo loans and non-conforming mortgages

- Develop and implement underwriting process improvements, resulting in a 20% increase in efficiency

- Collaborate with senior management to establish underwriting policies and risk tolerance levels

- Serve as a subject matter expert for regulatory audits and internal reviews

Senior Mortgage Underwriter

Golden State Bank

06/2013 - 07/2018

San Jose, CA

- Underwrote conventional, FHA, and VA mortgage loans, consistently meeting quality and turnaround time targets

- Conducted thorough risk assessments, including analysis of credit reports, income documentation, and property appraisals

- Mentored junior underwriters and provided guidance on complex underwriting scenarios

- Participated in the implementation of a new loan origination system, streamlining the underwriting process

Education

Master of Business Administration - Finance Concentration

University of California, Berkeley

09/2011 - 05/2013

Bachelor of Science - Economics

University of California, Los Angeles

09/2007 - 05/2011

Certifications

Certified Mortgage Underwriter (CMU)

Licensed Mortgage Loan Originator (NMLS)

Skills

Advanced mortgage underwriting • Risk assessment and mitigation • Regulatory compliance (FNMA, FHLMC, FHA, VA) • Team leadership and mentoring • Process improvement and optimization • Financial analysis and decision-making

Why this resume is great

This senior mortgage underwriter resume effectively demonstrates the candidate's extensive experience and leadership in the field. The professional experience section showcases a clear progression from senior underwriter to lead underwriter, highlighting key responsibilities and quantifiable achievements. The emphasis on team leadership, process improvement, and regulatory expertise positions the candidate as a valuable asset for high-level underwriting roles. The combination of advanced education, industry-specific certifications, and professional associations further reinforces the candidate's commitment to excellence in mortgage underwriting. This resume would be particularly appealing to employers seeking experienced underwriters capable of taking on leadership roles and driving strategic initiatives.

Commercial Underwriter Resume

A commercial underwriter resume example emphasizes expertise in assessing complex business risks and making informed policy decisions for diverse industries.

Build Your Commercial Underwriter ResumeJames Williams

[email protected] - (555) 876-5432 - Atlanta, GA - linkedin.com/in/example

About

Seasoned commercial underwriter with 8 years of experience in assessing complex business risks across diverse industries. Proven track record of developing tailored insurance solutions and maintaining a profitable portfolio. Seeking to leverage my expertise in a senior commercial underwriting role.

Experience

Senior Commercial Underwriter

Southeast Business Insurance

09/2019 - Present

Atlanta, GA

- Evaluate and underwrite complex commercial insurance policies for mid to large-sized businesses across various industries

- Conduct in-depth financial analysis and risk assessments to determine appropriate coverage and pricing

- Collaborate with brokers and risk engineers to develop customized insurance solutions for high-value accounts

- Manage a portfolio of $50 million in annual premium, consistently achieving profitability targets

- Lead training sessions for junior underwriters on industry-specific risk factors and underwriting techniques

Commercial Underwriter

Georgia Insurance Group

07/2015 - 08/2019

Atlanta, GA

- Underwrote property, liability, and workers' compensation policies for small to medium-sized businesses

- Analyzed financial statements, loss history, and industry trends to make informed underwriting decisions

- Developed and maintained relationships with key brokers, resulting in a 25% increase in new business submissions

- Participated in the development of underwriting guidelines for emerging risks in the technology sector

Education

Bachelor of Business Administration - Risk Management and Insurance

Georgia State University

09/2011 - 05/2015

Atlanta, GA

Certifications

Chartered Property Casualty Underwriter (CPCU)

Associate in Commercial Underwriting (AU)

Skills

Advanced commercial risk assessment • Financial statement analysis • Industry-specific risk evaluation • Negotiation and relationship management • Underwriting software proficiency (e.g., Guidewire, Duck Creek) • Team leadership and mentoring

Why this resume is great

This commercial underwriter resume effectively showcases the candidate's expertise in complex business risk assessment and policy development. The professional experience section highlights key responsibilities and quantifiable achievements, demonstrating the ability to manage large portfolios and drive business growth. The emphasis on industry-specific knowledge, financial analysis, and relationship management positions the candidate as a valuable asset for senior commercial underwriting roles. The inclusion of relevant certifications, professional associations, and notable achievements further reinforces the candidate's commitment to excellence in commercial underwriting. This resume would be particularly appealing to employers seeking experienced underwriters capable of handling diverse and complex commercial risks.

Life Insurance Underwriter Resume

A life insurance underwriter resume example demonstrates expertise in evaluating medical histories, lifestyle factors, and financial information to assess risk for life insurance policies.

Build Your Life Insurance Underwriter ResumeCharlotte Wilson

[email protected] - (555) 345-6789 - Denver, CO - linkedin.com/in/example

About

Dedicated life insurance underwriter with 6 years of experience in evaluating medical and financial risks for individual and group life insurance policies. Expertise in medical underwriting, financial analysis, and regulatory compliance. Seeking to leverage my skills in a senior life insurance underwriting role.

Experience

Senior Life Insurance Underwriter

Rocky Mountain Life Insurance Co.

03/2020 - Present

Denver, CO

- Evaluate complex life insurance applications, including high-value policies and cases with significant medical impairments

- Analyze medical records, laboratory results, and financial documents to assess mortality risk and determine appropriate ratings

- Collaborate with medical directors and reinsurers on challenging cases to develop optimal underwriting decisions

- Mentor junior underwriters and provide guidance on complex medical and financial underwriting scenarios

- Achieved a 95% accuracy rate in risk assessment, contributing to a 10% reduction in claims ratio

Life Insurance Underwriter

Colorado Insurance Group

06/2017 - 02/2020

Boulder, CO

- Underwrote individual and group life insurance policies, adhering to company guidelines and regulatory requirements

- Conducted thorough evaluations of medical histories, lifestyle factors, and financial information

- Utilized actuarial tables and underwriting software to determine appropriate risk classifications and premium rates

- Developed strong relationships with agents and brokers, providing education on underwriting decisions and policy features

Education

Bachelor of Science - Biology

University of Colorado Boulder

09/2013 - 05/2017

- Minor in Business

Certifications

Fellow, Life Management Institute (FLMI)

Associate, Customer Service (ACS)

Skills

Medical underwriting • Financial risk assessment • Actuarial analysis • Regulatory compliance (HIPAA, ACA) • Underwriting software proficiency • Critical thinking and decision-making • Communication and interpersonal skills

Why this resume is great

This life insurance underwriter resume effectively demonstrates the candidate's expertise in both medical and financial aspects of life insurance underwriting. The professional experience section showcases a progression from underwriter to senior underwriter, highlighting key responsibilities and quantifiable achievements. The emphasis on complex case evaluation, collaboration with medical professionals, and mentoring junior staff positions the candidate as a valuable asset for senior underwriting roles. The combination of a biology degree with business education, along with relevant certifications and continuing education, underscores the candidate's commitment to staying current in the field. This resume would be particularly appealing to employers seeking experienced life insurance underwriters capable of handling complex cases and contributing to team development.

Property and Casualty Underwriter Resume

A property and casualty underwriter resume example showcases expertise in assessing risks for various types of property and liability insurance policies.

Build Your Property and Casualty Underwriter ResumeIbrahim Rahman

[email protected] - (555) 987-1234 - Houston, TX - linkedin.com/in/example

About

Results-driven property and casualty underwriter with 7 years of experience in risk assessment and policy development for diverse insurance products. Expertise in commercial and personal lines underwriting, with a strong track record of portfolio profitability. Seeking to leverage my skills in a senior underwriting role to drive business growth and innovation.

Experience

Senior Property and Casualty Underwriter

Gulf Coast Insurance Solutions

05/2019 - Present

Houston, TX

- Evaluate and underwrite complex commercial and personal lines insurance policies, including property, general liability, and auto insurance

- Conduct comprehensive risk assessments for diverse industries, including oil and gas, manufacturing, and real estate

- Develop and implement underwriting guidelines for emerging risks, such as cyber liability and environmental exposures

- Manage a $40 million premium portfolio, consistently achieving loss ratio targets below industry average

- Mentor junior underwriters and lead training sessions on advanced underwriting techniques and industry trends

Property and Casualty Underwriter

Texas Insurance Group

06/2016 - 04/2019

Austin, TX

- Underwrote personal and small commercial insurance policies across multiple lines of business

- Analyzed loss history, inspection reports, and financial data to determine appropriate coverage and pricing

- Collaborated with agents and brokers to negotiate policy terms and conditions

- Participated in the development and implementation of a new underwriting platform, improving efficiency by 25%

Education

Bachelor of Business Administration - Risk Management and Insurance

University of Texas at Austin

09/2012 - 05/2016

Austin, TX

Certifications

Chartered Property Casualty Underwriter (CPCU)

Associate in General Insurance (AINS)

Skills

Advanced risk assessment and analysis • Policy development and pricing • Industry-specific knowledge (oil and gas, manufacturing, real estate) • Regulatory compliance (state insurance laws and regulations) • Underwriting software proficiency (Guidewire, Duck Creek) • Data analysis and interpretation • Negotiation and relationship management

Why this resume is great

This property and casualty underwriter resume effectively showcases the candidate's comprehensive experience across various insurance lines and industries. The professional experience section demonstrates a clear progression and highlights key responsibilities, achievements, and leadership skills. The emphasis on diverse risk assessment, portfolio management, and mentoring positions the candidate as an ideal fit for senior underwriting roles. The inclusion of industry-specific knowledge, particularly in high-risk sectors like oil and gas, adds significant value. The combination of relevant certifications, professional associations, and notable achievements further reinforces the candidate's expertise and commitment to excellence in the property and casualty insurance field.

Health Insurance Underwriter Resume

A health insurance underwriter resume example highlights expertise in evaluating medical risks, analyzing healthcare trends, and developing competitive group and individual health insurance policies.

Build Your Health Insurance Underwriter ResumeMartina Ramirez

[email protected] - (555) 234-5678 - Minneapolis, MN - linkedin.com/in/example

About

Experienced health insurance underwriter with 8 years of expertise in evaluating medical risks and developing competitive group and individual health insurance policies. Strong background in healthcare analytics, regulatory compliance, and product development. Seeking a leadership role to drive underwriting innovation and improve health outcomes.

Experience

Senior Health Insurance Underwriter

Midwest Health Solutions

07/2018 - Present

Minneapolis, MN

- Lead a team of 6 underwriters in evaluating and pricing group and individual health insurance policies

- Analyze complex medical histories, claims data, and industry trends to assess risk and determine appropriate premium rates

- Collaborate with actuaries and product development teams to design and implement new health insurance products

- Ensure compliance with ACA regulations and state-specific insurance laws

- Developed a predictive modeling approach for chronic disease management, resulting in a 15% reduction in claims costs

Health Insurance Underwriter

Minnesota Care Group

05/2015 - 06/2018

St. Paul, MN

- Underwrote group and individual health insurance policies, adhering to company guidelines and regulatory requirements

- Evaluated medical questionnaires, prescription drug histories, and claims data to assess health risks

- Worked closely with sales teams to provide underwriting guidance and support for new business opportunities

- Participated in the implementation of a new claims analysis system, improving underwriting accuracy by 20%

Education

Master of Public Health - Health Policy and Management

University of Minnesota

09/2013 - 05/2015

Minneapolis, MN

Bachelor of Science - Biology

University of Wisconsin-Madison

09/2009 - 05/2013

Madison, WI

Certifications

Certified Health Insurance Advanced Studies (CHIAS)

Registered Health Underwriter (RHU)

Skills

Advanced medical underwriting • Healthcare analytics and trend analysis • Regulatory compliance (ACA, HIPAA) • Group and individual policy underwriting • Leadership and team management • Product development and innovation • Data analysis and interpretation

Why this resume is great

This health insurance underwriter resume effectively demonstrates the candidate's expertise in both the technical and strategic aspects of health insurance underwriting. The professional experience section showcases a clear progression from underwriter to senior underwriter, highlighting key responsibilities, achievements, and leadership skills. The emphasis on healthcare analytics, product development, and regulatory compliance positions the candidate as a valuable asset for leadership roles in health insurance underwriting. The combination of a public health master's degree with biology background provides a strong foundation for understanding complex health risks. The inclusion of relevant certifications, professional associations, and notable achievements further reinforces the candidate's commitment to innovation and excellence in the health insurance field.

Auto Insurance Underwriter Resume

An auto insurance underwriter resume example showcases expertise in evaluating vehicle and driver risks, analyzing claims history, and determining appropriate coverage and premiums for personal and commercial auto policies.

Build Your Auto Insurance Underwriter ResumeNoah Smith

[email protected] - (555) 876-5432 - Columbus, OH - linkedin.com/in/example

About

Detail-oriented auto insurance underwriter with 6 years of experience in assessing vehicle and driver risks for personal and commercial auto policies. Expertise in utilizing advanced analytics, telematics data, and industry trends to optimize underwriting decisions. Seeking to leverage my skills in a senior auto insurance underwriting role to drive portfolio profitability and innovation.

Experience

Senior Auto Insurance Underwriter

Buckeye Auto Insurance

08/2020 - Present

Columbus, OH

- Lead the underwriting process for complex personal and commercial auto insurance policies, including high-risk and specialty vehicles

- Analyze telematics data, claims history, and driver profiles to accurately assess risk and determine appropriate premiums

- Develop and implement underwriting guidelines for emerging risks, such as ride-sharing and autonomous vehicles

- Collaborate with actuaries and data scientists to refine predictive models for auto risk assessment

- Manage a $30 million premium portfolio, consistently achieving loss ratio targets below industry average

Auto Insurance Underwriter

Midwest Motors Insurance

06/2017 - 07/2020

Cincinnati, OH

- Evaluated and underwrote personal and commercial auto insurance policies, adhering to company guidelines and state regulations

- Conducted thorough risk assessments using motor vehicle reports, credit scores, and claims history

- Worked closely with agents and brokers to provide underwriting guidance and support for new business opportunities

- Participated in the implementation of a new usage-based insurance program, resulting in a 15% increase in policy retention

Education

Bachelor of Science - Business Administration, Insurance and Risk Management

Ohio State University

09/2013 - 05/2017

Columbus, OH

Certifications

Associate in Personal Insurance (API)

Certified Automobile Insurance Specialist (CAIS)

Skills

Advanced auto risk assessment • Telematics data analysis • Predictive modeling interpretation • Regulatory compliance (state auto insurance laws) • Underwriting software proficiency • Critical thinking and decision-making • Communication and negotiation

Why this resume is great

This auto insurance underwriter resume effectively showcases the candidate's expertise in both traditional and emerging areas of auto insurance underwriting. The professional experience section demonstrates a clear progression and highlights key responsibilities, achievements, and technical skills. The emphasis on telematics data analysis, predictive modeling, and emerging risks like ride-sharing and autonomous vehicles positions the candidate as forward-thinking and adaptable. The combination of relevant certifications, professional associations, and continuing education underscores the candidate's commitment to staying current in a rapidly evolving field. This resume would be particularly appealing to employers seeking experienced auto insurance underwriters capable of leveraging advanced technologies and data analytics to optimize underwriting decisions and drive portfolio profitability.

Loan Underwriter Resume

A loan underwriter resume example emphasizes expertise in evaluating creditworthiness, analyzing financial documents, and assessing risk for various types of loans, including personal, mortgage, and business loans.

Build Your Loan Underwriter ResumeMateo Sanchez

[email protected] - (555) 123-9876 - Miami, FL - linkedin.com/in/example

About

Results-driven loan underwriter with 7 years of experience in evaluating creditworthiness and assessing risk for diverse loan products. Expertise in personal, mortgage, and business loan underwriting, with a strong track record of maintaining portfolio quality. Seeking to leverage my skills in a senior loan underwriting role to optimize lending decisions and drive business growth.

Experience

Senior Loan Underwriter

Sunshine State Bank

09/2019 - Present

Miami, FL

- Lead the underwriting process for complex loan applications, including jumbo mortgages, commercial real estate loans, and SBA loans

- Analyze financial statements, tax returns, credit reports, and collateral valuations to assess borrower creditworthiness and loan viability

- Develop and implement underwriting guidelines for new loan products, ensuring compliance with regulatory requirements and risk tolerance levels

- Collaborate with loan officers and branch managers to structure deals and mitigate risks

- Manage a loan portfolio of $100 million, maintaining delinquency rates below 2%

Loan Underwriter

Florida First Credit Union

06/2016 - 08/2019

Orlando, FL

- Underwrote personal, auto, and home equity loans, adhering to credit union policies and regulatory guidelines

- Evaluated loan applications, verifying income, employment, and assets to determine borrower eligibility

- Conducted risk assessments and recommended appropriate loan terms and conditions

- Participated in the implementation of a new loan origination system, improving underwriting efficiency by 30%

Education

Bachelor of Science - Finance

University of Florida

09/2012 - 05/2016

Gainesville, FL

Certifications

Certified Mortgage Underwriter (CMU)

Commercial Lending Certificate

Skills

Advanced credit analysis • Financial statement interpretation • Risk assessment and mitigation • Regulatory compliance (FCRA, ECOA, TILA) • Loan origination software proficiency • Decision-making and problem-solving • Communication and negotiation

Why this resume is great

This loan underwriter resume effectively demonstrates the candidate's comprehensive experience across various loan types and financial institutions. The professional experience section showcases a clear progression from credit union to commercial bank underwriting, highlighting key responsibilities, achievements, and technical skills. The emphasis on complex loan products, portfolio management, and process improvement positions the candidate as an ideal fit for senior underwriting roles. The combination of relevant certifications, professional associations, and continuing education underscores the candidate's commitment to staying current in the evolving landscape of lending regulations and best practices. This resume would be particularly appealing to employers seeking experienced loan underwriters capable of handling diverse loan products and contributing to strategic growth initiatives.

Risk Underwriter Resume

A risk underwriter resume example highlights expertise in assessing and quantifying various types of risks across different industries, developing risk mitigation strategies, and making informed underwriting decisions.

Build Your Risk Underwriter ResumeVictoria Rodriguez

[email protected] - (555) 987-6543 - Chicago, IL - linkedin.com/in/example

About

Strategic risk underwriter with 8 years of experience in assessing and quantifying complex risks across multiple industries. Expertise in developing risk mitigation strategies, pricing models, and portfolio optimization. Seeking a leadership role to drive innovation in risk assessment and underwriting practices.

Experience

Senior Risk Underwriter

Midwest Risk Solutions

07/2018 - Present

Chicago, IL

- Lead a team of 5 risk underwriters in evaluating and pricing complex risks for Fortune 500 companies across various industries

- Develop and implement advanced risk assessment models, incorporating both quantitative and qualitative factors

- Collaborate with actuaries, claims specialists, and risk engineers to refine underwriting guidelines and pricing strategies

- Manage a diverse risk portfolio with an annual premium of $75 million, consistently achieving profitability targets

- Spearhead the integration of machine learning algorithms into the underwriting process, improving risk prediction accuracy by 25%

Risk Underwriter

Great Lakes Insurance Group

05/2015 - 06/2018

Milwaukee, WI

- Assessed and underwrote risks for mid-sized businesses in manufacturing, technology, and healthcare sectors

- Conducted thorough risk analyses, including financial statement reviews, site inspections, and industry trend evaluations

- Developed tailored risk mitigation recommendations and coverage solutions for clients

- Participated in the creation of a new cyber risk underwriting framework, contributing to a 30% growth in cyber insurance premiums

Education

Master of Science - Risk Management and Insurance

DePaul University

09/2013 - 05/2015

Chicago, IL

Bachelor of Business Administration - Finance

University of Wisconsin-Madison

09/2009 - 05/2013

Madison, WI

Certifications

Chartered Property Casualty Underwriter (CPCU)

Associate in Risk Management (ARM)

Skills

Advanced risk modeling and analysis • Industry-specific risk assessment (manufacturing, technology, healthcare) • Financial statement interpretation • Data analytics and predictive modeling • Regulatory compliance across multiple jurisdictions • Leadership and team management • Strategic thinking and problem-solving

Why this resume is great

This risk underwriter resume effectively showcases the candidate's expertise in complex risk assessment and strategic underwriting across multiple industries. The professional experience section demonstrates a clear progression and highlights key responsibilities, achievements, and leadership skills. The emphasis on advanced risk modeling, portfolio management, and innovation in underwriting practices positions the candidate as a valuable asset for senior risk management roles. The combination of a specialized master's degree, relevant certifications, and ongoing professional development underscores the candidate's commitment to excellence in the rapidly evolving field of risk underwriting. This resume would be particularly appealing to employers seeking experienced risk underwriters capable of leveraging advanced analytics and industry knowledge to optimize risk assessment and drive portfolio profitability.

Reinsurance Underwriter Resume

A reinsurance underwriter resume example demonstrates expertise in evaluating complex risks, analyzing treaties, and developing reinsurance solutions for insurance companies across various lines of business.

Build Your Reinsurance Underwriter ResumeNikola Papadopoulos

[email protected] - (555) 234-5678 - New York, NY - linkedin.com/in/example

About

Strategic reinsurance underwriter with 9 years of experience in evaluating complex risks and developing tailored reinsurance solutions across multiple lines of business. Expertisein treaty and facultative reinsurance, catastrophe modeling, and portfolio optimization. Seeking a senior leadership role to drive innovation and growth in the reinsurance sector.

Experience

Senior Reinsurance Underwriter

Global Re Solutions

08/2017 - Present

New York, NY

- Lead the underwriting of complex treaty and facultative reinsurance programs for top-tier insurance companies globally

- Analyze and price property, casualty, and specialty risks, including natural catastrophe exposures and emerging risks

- Develop innovative reinsurance structures to address clients' risk transfer needs and capital management objectives

- Collaborate with actuaries, cat modelers, and claims specialists to refine underwriting guidelines and pricing models

- Manage a diverse reinsurance portfolio with $200 million in annual premium, consistently achieving profitability targets

- Mentor junior underwriters and lead training sessions on advanced reinsurance concepts and market trends

Reinsurance Underwriter

Atlantic Reinsurance Group

06/2014 - 07/2017

Boston, MA

- Underwrote property and casualty treaty reinsurance programs for regional and national insurance companies

- Conducted thorough risk assessments, including exposure analysis, loss history evaluation, and catastrophe modeling

- Negotiated treaty terms and conditions with brokers and cedents, ensuring alignment with company risk appetite

- Participated in the development of a new cyber reinsurance product, contributing to a 40% growth in this segment

Education

Master of Science - Actuarial Science

Columbia University

09/2012 - 05/2014

New York, NY

Bachelor of Science - Mathematics

University of Massachusetts Amherst

09/2008 - 05/2012

Certifications

Associate of the Casualty Actuarial Society

Certified Catastrophe Risk Management Professional

Skills

Advanced treaty and facultative reinsurance underwriting • Catastrophe modeling (RMS, AIR) • Financial analysis and capital modeling • Contract wording and negotiation • Emerging risk assessment • Data analytics and predictive modeling • Strategic thinking and problem-solving

Why this resume is great

This reinsurance underwriter resume effectively demonstrates the candidate's expertise in complex risk assessment and innovative reinsurance solutions across multiple lines of business. The professional experience section showcases a clear progression and highlights key responsibilities, achievements, and leadership skills. The emphasis on both treaty and facultative reinsurance, coupled with strong technical skills in catastrophe modeling and financial analysis, positions the candidate as an ideal fit for senior reinsurance underwriting roles. The combination of actuarial education, relevant certifications, and ongoing professional development underscores the candidate's commitment to excellence in the sophisticated field of reinsurance. This resume would be particularly appealing to employers seeking experienced reinsurance underwriters capable of developing innovative solutions and driving strategic growth in the global reinsurance market.

Marine Underwriter Resume

A marine underwriter resume example showcases expertise in assessing risks associated with maritime operations, cargo transportation, and offshore energy projects, demonstrating a deep understanding of the shipping industry and marine insurance products.

Build Your Marine Underwriter ResumeLiam O'Connor

[email protected] - +44 20 1234 5678 - London, UK - linkedin.com/in/example

About

Seasoned marine underwriter with 10 years of experience in assessing and pricing risks for diverse maritime operations and cargo transportation. Expertise in hull and machinery, protection and indemnity (P&I), and cargo insurance. Seeking a leadership role to drive innovation and growth in the marine insurance sector.

Experience

Senior Marine Underwriter

Atlantic Marine Insurance

09/2016 - Present

London, UK

- Lead the underwriting of complex marine risks, including ocean-going vessels, offshore energy projects, and global cargo transportation

- Analyze and price hull and machinery, P&I, cargo, and marine liability risks for a diverse portfolio of international clients

- Develop tailored insurance solutions for unique maritime risks, including specialized vessels and emerging technologies

- Collaborate with brokers, surveyors, and claims adjusters to optimize risk assessment and policy terms

- Manage a marine insurance portfolio with £150 million in annual premium, consistently achieving profitability targets

- Mentor junior underwriters and conduct training sessions on advanced marine insurance concepts and industry trends

Marine Underwriter

Mediterranean Shipping Insurance

07/2013 - 08/2016

Athens, Greece

- Underwrote hull and machinery, cargo, and marine liability policies for Mediterranean and Black Sea shipping operations

- Conducted thorough risk assessments, including vessel inspections, route analysis, and cargo valuation

- Negotiated policy terms and conditions with brokers and shipowners, ensuring alignment with company risk appetite

- Participated in the development of a new cyber risk coverage for maritime operations, contributing to a 25% growth in this segment

Education

Master of Science - Maritime Economics and Logistics

Erasmus University Rotterdam

09/2011 - 06/2013

Netherlands

Bachelor of Science - Naval Architecture and Marine Engineering

University of Strathclyde

09/2007 - 05/2011

Glasgow, UK

Certifications

Fellow of the Chartered Insurance Institute (FCII)

Associate in Marine Insurance Management (AMIM)

Skills

Advanced marine risk assessment • Hull and machinery underwriting • P&I and marine liability expertise • Cargo insurance and logistics • Maritime law and regulations • Offshore energy risk evaluation • Data analytics and predictive modeling

Why this resume is great

This marine underwriter resume effectively showcases the candidate's deep expertise in maritime risk assessment and insurance solutions across various segments of the marine industry. The professional experience section demonstrates a clear progression and highlights key responsibilities, achievements, and technical skills specific to marine underwriting. The combination of maritime engineering education and specialized insurance qualifications provides a strong foundation for understanding complex marine risks. The emphasis on developing innovative solutions for emerging risks, such as cyber coverage and parametric insurance for port operations, positions the candidate as a forward-thinking leader in the field. This resume would be particularly appealing to employers seeking experienced marine underwriters capable of managing diverse portfolios and driving growth in specialized marine insurance markets.

Aviation Underwriter Resume

An aviation underwriter resume example highlights expertise in assessing risks associated with aircraft operations, airline companies, and aerospace manufacturing, demonstrating a deep understanding of the aviation industry and specialized insurance products.

Build Your Aviation Underwriter ResumeYuki Zhang

[email protected] - (555) 876-5432 - Los Angeles, CA - linkedin.com/in/example

About

Dynamic aviation underwriter with 8 years of experience in evaluating and pricing risks for diverse segments of the aviation industry. Expertise in airline operations, general aviation, and aerospace product liability. Seeking a senior role to drive innovation and growth in aviation insurance underwriting.

Experience

Senior Aviation Underwriter

Pacific Skies Insurance

11/2018 - Present

Los Angeles, CA

- Lead the underwriting of complex aviation risks, including commercial airlines, corporate fleets, and aerospace manufacturers

- Analyze and price hull and liability risks for a diverse portfolio of international aviation clients

- Develop tailored insurance solutions for unique aviation risks, including unmanned aerial vehicles (UAVs) and space tourism

- Collaborate with aviation safety experts, engineers, and claims specialists to optimize risk assessment and policy terms

- Manage an aviation insurance portfolio with $100 million in annual premium, consistently achieving profitability targets

- Mentor junior underwriters and conduct training sessions on advanced aviation insurance concepts and industry trends

Aviation Underwriter

Midwest Aviation Group

08/2015 - 10/2018

Chicago, IL

- Underwrote hull and liability policies for general aviation, including private aircraft, charter operations, and flight schools

- Conducted thorough risk assessments, including pilot experience evaluation, aircraft inspections, and operational audits

- Negotiated policy terms and conditions with brokers and aviation clients, ensuring alignment with company risk appetite

- Participated in the development of a new insurance product for drone operations, contributing to a 30% growth in this segment

Education

Master of Science - Aviation Safety

University of Southern California

09/2013 - 05/2015

Los Angeles, CA

Bachelor of Science - Aerospace Engineering

Purdue University

09/2009 - 05/2013

West Lafayette, IN

Certifications

Chartered Property Casualty Underwriter (CPCU)

Associate in Aviation Insurance (AAI)

Skills

Advanced aviation risk assessment • Airline hull and liability underwriting • General aviation insurance expertise • Aerospace product liability evaluation • Aviation regulations and compliance • UAV and space risk analysis • Data analytics and predictive modeling

Why this resume is great

This aviation underwriter resume effectively demonstrates the candidate's comprehensive expertise in assessing and pricing risks across various segments of the aviation industry. The professional experience section showcases a clear progression and highlights key responsibilities, achievements, and technical skills specific to aviation underwriting. The combination of aerospace engineering education and specialized aviation safety qualifications provides a strong foundation for understanding complex aviation risks. The emphasis on developing innovative solutions for emerging risks, such as UAVs and eVTOL aircraft, positions the candidate as a forward-thinking leader in the field. This resume would be particularly appealing to employers seeking experienced aviation underwriters capable of managing diverse portfolios and driving growth in specialized aviation insurance markets.

Cyber Insurance Underwriter Resume

A cyber insurance underwriter resume example showcases expertise in assessing and pricing digital risks, demonstrating a deep understanding of cybersecurity, data protection, and emerging technologies.

Build Your Cyber Insurance Underwriter ResumeClara Ferrari

[email protected] - (555) 234-5678 - San Francisco, CA - linkedin.com/in/example

About

Innovative cyber insurance underwriter with 7 years of experience in evaluating and pricing digital risks for diverse industries. Expertise in cybersecurity assessment, data breach response, and emerging technology risks. Seeking a senior role to drive growth and innovation in the rapidly evolving cyber insurance market.

Experience

Senior Cyber Insurance Underwriter

TechShield Insurance

03/2019 - Present

San Francisco, CA

- Lead the underwriting of complex cyber risks for Fortune 500 companies across various industries, including technology, healthcare, and financial services

- Analyze and price cyber liability, data breach, and technology E&O risks for a diverse portfolio of global clients

- Develop innovative insurance solutions for emerging digital risks, including cryptocurrency, AI liability, and IoT vulnerabilities

- Collaborate with cybersecurity experts, data scientists, and claims specialists to refine risk assessment methodologies and policy wordings

- Manage a cyber insurance portfolio with $80 million in annual premium, consistently achieving profitability targets

- Mentor junior underwriters and conduct training sessions on advanced cyber risk concepts and regulatory developments

Cyber Risk Underwriter

Digital Fortress Insurance

06/2016 - 02/2019

New York, NY

- Underwrote cyber liability and technology E&O policies for small to medium-sized businesses across various sectors

- Conducted thorough cyber risk assessments, including network security evaluations, data protection practices, and incident response capabilities

- Negotiated policy terms and conditions with brokers and clients, ensuring alignment with company risk appetite

- Participated in the development of a new ransomware coverage product, contributing to a 40% growth in this segment

Education

Master of Science - Information Security

Carnegie Mellon University

09/2014 - 05/2016

Pittsburgh, PA

Bachelor of Science - Computer Science

University of California, Berkeley

09/2010 - 05/2014

Berkeley, CA

Certifications

Certified Information Systems Security Professional (CISSP)

Certified Information Privacy Professional (CIPP/US)

Skills

Advanced cyber risk assessment • Cybersecurity and data protection expertise • Technology E&O underwriting • Emerging technology risk evaluation • Regulatory compliance (GDPR, CCPA, HIPAA) • Data analytics and predictive modeling • Incident response and business continuity planning

Why this resume is great

This cyber insurance underwriter resume effectively showcases the candidate's expertise in assessing and pricing digital risks across various industries and technologies. The professional experience section demonstrates a clear progression and highlights key responsibilities, achievements, and technical skills specific to cyber underwriting. The combination of computer science education and specialized cybersecurity certifications provides a strong foundation for understanding complex digital risks. The emphasis on developing innovative solutions for emerging risks, such as AI liability and IoT vulnerabilities, positions the candidate as a forward-thinking leader in the rapidly evolving field of cyber insurance. This resume would be particularly appealing to employers seeking experienced cyber underwriters capable of managing diverse portfolios and driving growth in this dynamic and challenging insurance market.

Agricultural Underwriter Resume

An agricultural underwriter resume example highlights expertise in assessing risks associated with crop production, livestock operations, and farm equipment, demonstrating a deep understanding of the agricultural industry and specialized insurance products.

Build Your Agricultural Underwriter ResumeMateo Santos

[email protected] - (555) 987-6543 - Des Moines, IA - linkedin.com/in/example

About

Experienced agricultural underwriter with 9 years of expertise in evaluating and pricing risks for diverse farming operations and agribusinesses. Specialized knowledge in crop insurance, livestock coverage, and farm equipment protection. Seeking a senior role to drive innovation and growth in agricultural risk management.

Experience

Senior Agricultural Underwriter

Heartland Farm Insurance

05/2017 - Present

Des Moines, IA

- Lead the underwriting of complex agricultural risks for large-scale farming operations, cooperatives, and agribusinesses across the Midwest

- Analyze and price multi-peril crop insurance, livestock mortality, and farm property risks for a diverse portfolio of clients

- Develop tailored insurance solutions for emerging agricultural risks, including precision farming technologies and sustainable agriculture practices

- Collaborate with agronomists, veterinarians, and claims adjusters to refine risk assessment methodologies and policy terms

- Manage an agricultural insurance portfolio with $120 million in annual premium, consistently achieving profitability targets

- Mentor junior underwriters and conduct training sessions on advanced agricultural risk concepts and industry trends

Agricultural Underwriter

Great Plains Insurance Group

08/2014 - 04/2017

Omaha, NE

- Underwrote crop insurance and farm property policies for small to medium-sized farming operations in the Great Plains region

- Conducted thorough risk assessments, including soil quality evaluation, climate pattern analysis, and farm management practices review

- Negotiated policy terms and conditions with agents and farmers, ensuring alignment with company risk appetite

- Participated in the development of a new weather index insurance product for specialty crops, contributing to a 25% growth in this segment

Education

Master of Science - Agricultural Economics

Iowa State University

09/2012 - 05/2014

Ames, IA

Bachelor of Science - Agronomy

University of Nebraska-Lincoln

09/2008 - 05/2012

Certifications

Certified Crop Insurance Specialist (CCIS)

Agribusiness and Farm Insurance Specialist (AFIS)

Skills

Advanced agricultural risk assessment • Multi-peril crop insurance expertise • Livestock mortality and farm property underwriting • Climate and weather pattern analysis • Precision agriculture technology evaluation • Data analytics and predictive modeling • Regulatory compliance (USDA, RMA guidelines)

Why this resume is great

This agricultural underwriter resume effectively demonstrates the candidate's comprehensive expertise in assessing and pricing risks across various segments of the agricultural industry. The professional experience section showcases a clear progression and highlights key responsibilities, achievements, and technical skills specific to agricultural underwriting. The combination of agronomy and agricultural economics education provides a strong foundation for understanding complex farming risks. The emphasis on developing innovative solutions for emerging risks, such as precision farming technologies and sustainable agriculture practices, positions the candidate as a forward-thinking leader in the field. This resume would be particularly appealing to employers seeking experienced agricultural underwriters capable of managing diverse portfolios and driving growth in specialized agricultural insurance markets.

How to Write an Underwriter Resume

Underwriter Resume Outline

An effective underwriter resume should follow a clear and concise structure that highlights your relevant skills, experience, and qualifications. Here's a recommended outline:

- Contact Information: Include your full name, location, phone number, email, and LinkedIn profile.

- Professional Summary: A brief statement highlighting your key qualifications and career objectives.

- Work Experience: List your relevant work history in reverse chronological order, focusing on achievements and responsibilities.

- Education: Include your degrees, majors, and institutions attended.

- Skills: Highlight both technical and soft skills relevant to underwriting.

- Certifications: List any professional certifications you've earned.

- Professional Associations: Mention any relevant industry memberships.

- Achievements: Include any notable accomplishments or awards in your underwriting career.

Which Resume Layout Should an Underwriter Use?

Underwriters should typically use a reverse-chronological resume layout, which emphasizes your work history and career progression. This format is preferred by most employers and applicant tracking systems (ATS). However, if you're changing careers or have limited experience, a combination resume format might be more suitable, allowing you to highlight your transferable skills alongside your work history.

What Your Underwriter Resume Header Should Include

Your underwriter resume header should include essential contact information to make it easy for employers to reach you. Here are some examples:

John Smith

[email protected] - (555) 123-4567 - Chicago, IL - linkedin.com/in/example

Why it works

• Full name prominently displayed • City and state (no need for full address) • Phone number • Professional email address • LinkedIn profile URL

J. Smith

Bad example

• Incomplete name • Missing location information • No phone number provided • Unprofessional email address • Missing LinkedIn profile

What Your Underwriter Resume Summary Should Include

An effective underwriter resume summary should concisely highlight your key qualifications, experience, and career objectives. It should be tailored to the specific underwriting role you're applying for and include:

- Years of experience in underwriting

- Specific areas of expertise (e.g., insurance lines, loan types)

- Key skills relevant to the position

- Notable achievements or certifications

- Career objectives or value proposition

Underwriter Resume Summary Examples

Lawrence Starkey

About

Experienced property and casualty underwriter with 7 years of expertise in commercial lines. Proven track record of maintaining a profitable portfolio and developing innovative risk assessment models. Seeking to leverage my skills in a senior underwriting role to drive portfolio growth and optimize risk management strategies.

Why it works

• Specifies years of experience and area of expertise • Highlights key achievements • Indicates career objective • Emphasizes value proposition to potential employer

Edna Odell

About

Underwriter with experience in insurance looking for a new job opportunity.

Issues

• Lacks specific details about experience or expertise • No mention of achievements or skills • Vague career objective • Fails to demonstrate value to potential employer

What Are the Most Common Underwriter Responsibilities?

Underwriter responsibilities can vary depending on the specific field (e.g., insurance, mortgage, loan) and level of experience. However, some common responsibilities include:

- Evaluating applications for insurance coverage or loans

- Analyzing financial documents, credit reports, and other relevant information

- Assessing risks associated with potential clients or properties

- Determining appropriate premiums, loan amounts, or interest rates

- Developing and implementing underwriting guidelines

- Collaborating with agents, brokers, or loan officers

- Ensuring compliance with regulatory requirements

- Maintaining and updating client records

- Participating in continuous education and staying current with industry trends

- Contributing to the development of new products or underwriting tools

What Your Underwriter Resume Experience Should Include

Your underwriter resume experience section should highlight your relevant work history, emphasizing your achievements and responsibilities. When describing your experience, focus on:

- Specific underwriting roles and the industries you've worked in

- Key responsibilities that demonstrate your expertise

- Quantifiable achievements and their impact on the business

- Projects or initiatives you've led or contributed to

- Skills and tools you've utilized in your roles

- Collaborations with other departments or external partners

Use action verbs and specific metrics to make your experience more impactful and demonstrate your value to potential employers.

Underwriter Resume Experience Examples

Experience

Senior Underwriter

Pacific Insurance Group

09/2018 - Present

Los Angeles, CA

- Manage a diverse portfolio of commercial property and liability risks with an annual premium of $50 million

- Developed and implemented a new risk assessment model, reducing loss ratios by 15% over two years

- Lead a team of 5 junior underwriters, providing mentorship and training on complex risk evaluation techniques

- Collaborate with actuaries and data scientists to refine pricing models, resulting in a 10% increase in policy retention rates

- Spearheaded the integration of AI-driven risk analysis tools, improving underwriting efficiency by 25%

Why it works

• Clearly states job title, company, location, and dates of employment • Highlights specific responsibilities and areas of expertise • Includes quantifiable achievements and their impact • Demonstrates leadership and collaboration skills • Showcases innovation and use of advanced technologies

Experience

Underwriter

Insurance Company

2015 - 2018

- Reviewed insurance applications

- Calculated premiums

- Worked with agents

Bad example

• Lacks specific details about the company and location • Uses vague date range instead of specific months and years • Provides minimal information about responsibilities • No mention of achievements or impact • Fails to demonstrate growth or expertise in the role

What's the Best Education for an Underwriter Resume?

The best education for an underwriter resume typically includes a bachelor's degree in a relevant field. While specific degree requirements may vary depending on the industry and employer, some common educational backgrounds for underwriters include:

- Finance

- Business Administration

- Economics

- Accounting

- Mathematics

- Statistics

- Risk Management and Insurance

For more specialized underwriting roles, degrees in fields such as computer science (for cyber insurance), engineering (for property insurance), or health sciences (for life and health insurance) may be valuable.

Additionally, many underwriters pursue advanced degrees such as an MBA or specialized master's programs in areas like risk management, actuarial science, or financial engineering to enhance their expertise and career prospects.

When listing your education on your resume, include the following information:

- Degree earned

- Major or concentration

- Name of the institution

- Location of the institution

- Graduation date (or expected graduation date)

- GPA (if it's 3.5 or higher)

- Relevant coursework, honors, or academic achievements (optional)

Remember to list your educational background in reverse chronological order, with your most recent degree first.

What's the Best Professional Organization for an Underwriter Resume?

Including professional organizations on your underwriter resume demonstrates your commitment to ongoing professional development and industry engagement. The best professional organizations for underwriters can vary depending on your specific field of underwriting. Here are some notable organizations to consider:

- The Institutes: Offers various designations, including the Chartered Property Casualty Underwriter (CPCU)

- National Association of Insurance and Financial Advisors (NAIFA)

- Professional Insurance Agents (PIA)

- American Academy of Actuaries (AAA)

- Risk and Insurance Management Society (RIMS)

- Mortgage Bankers Association (MBA)

- National Association of Mortgage Underwriters (NAMU)

- Association of Insurance Compliance Professionals (AICP)

- International Association of Credit Portfolio Managers (IACPM)

- American Bankers Association (ABA)

When listing professional organizations on your resume, include:

- The full name of the organization

- Your membership status (e.g., member, associate member)

- Any leadership roles or committee participation

- Years of membership (optional)

Participation in professional organizations can enhance your resume skills section and demonstrate your commitment to staying current in your field.

What Are the Best Awards for an Underwriter Resume?

Including relevant awards on your underwriter resume can significantly boost your credibility and showcase your expertise. While specific awards may vary depending on your company, industry, and specialization, here are some types of awards that can be valuable to include:

- Underwriter of the Year (company or industry-wide)

- Top Performer or President's Club recognition

- Innovation in Underwriting awards

- Risk Management Excellence awards

- Customer Service Excellence recognition

- Leadership or Mentorship awards

- Industry-specific awards (e.g., Best Cyber Underwriter, Top Mortgage Underwriter)

- Professional association awards or honors

- Academic awards or scholarships related to underwriting or risk management

When listing awards on your resume, include:

- The name of the award

- The organization or entity that presented the award

- The year you received the award

- A brief description of the award's significance (if not self-evident)

Remember to focus on awards that are most relevant to your target role and demonstrate your expertise in underwriting.

What Are Good Volunteer Opportunities for an Underwriter Resume?

Including volunteer experience on your underwriter resume can demonstrate your commitment to community service and showcase valuable skills. While not all volunteer opportunities need to be directly related to underwriting, those that highlight relevant skills or industry connections can be particularly impactful. Here are some volunteer opportunities that could be beneficial for an underwriter's resume:

- Financial literacy programs: Teaching budgeting or insurance basics to students or community members

- Disaster relief organizations: Assisting with risk assessment or claims processing for affected communities

- Small business mentorship: Advising entrepreneurs on risk management and insurance needs

- Professional association committees: Serving on committees related to education, ethics, or industry standards

- Community development organizations: Helping with risk assessments for local projects or initiatives

- Environmental conservation groups: Assisting with risk analysis for conservation projects

- Healthcare organizations: Volunteering in roles that involve data analysis or patient advocacy

- Local government advisory boards: Serving on committees related to risk management or financial planning

When including volunteer experience on your resume, focus on:

- The name of the organization

- Your role or position

- The duration of your involvement

- Key responsibilities or achievements

- Skills utilized or developed through the experience

Volunteering can be an excellent way to develop new skills, expand your network, and demonstrate your commitment to professional growth and community service.

What Are the Best Hard Skills to Add to an Underwriter Resume?

Hard skills are specific, teachable abilities that are essential for success in underwriting roles. Including relevant hard skills on your resume can demonstrate your technical proficiency and make you a more attractive candidate. Here are some of the best hard skills to consider adding to your underwriter resume:

- Risk assessment and analysis

- Financial statement analysis

- Underwriting software proficiency (e.g., Guidewire, Duck Creek, Vertafore)

- Dataanalytics and interpretation

- Statistical modeling

- Actuarial analysis

- Policy pricing and rating

- Regulatory compliance knowledge

- Industry-specific expertise (e.g., property & casualty, life & health, mortgage)

- Advanced Excel skills

- SQL or database management

- Predictive modeling

- Financial modeling

- Claims analysis

- Business valuation

- Credit analysis

- Risk mitigation strategies

- Underwriting automation tools

- Cybersecurity risk assessment (for cyber insurance)

When listing hard skills on your resume, be sure to tailor them to the specific job requirements and highlight those that are most relevant to the position you're applying for. Additionally, consider using a skills section to prominently display your key technical abilities.

What Are the Best Soft Skills to Add to an Underwriter Resume?

While hard skills are crucial for demonstrating technical proficiency, soft skills are equally important in the underwriting profession. These interpersonal and behavioral attributes can set you apart as a well-rounded candidate. Here are some of the best soft skills to consider adding to your underwriter resume:

- Analytical thinking

- Attention to detail

- Decision-making

- Problem-solving

- Communication (written and verbal)

- Negotiation

- Time management

- Adaptability

- Teamwork and collaboration

- Critical thinking

- Ethical judgment

- Customer service orientation

- Stress management

- Continuous learning

- Leadership

- Relationship building

- Emotional intelligence

- Conflict resolution

- Creativity in risk assessment

- Cultural sensitivity

When incorporating soft skills into your resume, it's best to demonstrate them through specific examples in your work experience section rather than simply listing them. Use concrete situations where you've applied these skills to achieve positive outcomes in your underwriting career.

What Are the Best Certifications for an Underwriter Resume?

Professional certifications can significantly enhance your credibility as an underwriter and demonstrate your commitment to ongoing education in the field. The best certifications for your resume will depend on your specific area of underwriting and career goals. Here are some widely recognized certifications to consider:

- Chartered Property Casualty Underwriter (CPCU)

- Associate in Commercial Underwriting (AU)

- Certified Mortgage Underwriter (CMU)

- Certified Insurance Service Representative (CISR)

- Associate in Personal Insurance (API)

- Certified Risk Manager (CRM)

- Associate in Reinsurance (ARe)

- Life Underwriter Training Council Fellow (LUTCF)

- Certified Financial Risk Manager (FRM)

- Certified Underwriting and Claims Professional (CUCP)

- Associate in General Insurance (AINS)

- Certified Insurance Counselor (CIC)

- Chartered Life Underwriter (CLU)

- Associate in Risk Management (ARM)

- Certified Cyber Insurance Specialist (CCIS)

When listing certifications on your resume, include:

- The full name of the certification

- The certifying organization

- The date of certification or expiration date (if applicable)

Remember to prioritize certifications that are most relevant to your target role and demonstrate your expertise in specific areas of underwriting.

Tips for an Effective Underwriter Resume

- To create a standout underwriter resume, consider the following tips:

- Tailor your resume to the specific underwriting role and company you're applying to.

- Use industry-specific keywords to optimize your resume for applicant tracking systems (ATS).

- Quantify your achievements with specific metrics and results whenever possible.

- Highlight your expertise in relevant underwriting software and tools.

- Showcase your knowledge of industry regulations and compliance standards.

- Emphasize your analytical skills and attention to detail throughout your resume.

- Include any specialized knowledge or experience in niche areas of underwriting.

- Demonstrate your ability to balance risk assessment with business growth objectives.

- Highlight any experience with process improvement or innovation in underwriting practices.

- Include relevant continuing education or professional development activities.

How Long Should I Make My Underwriter Resume?

The ideal length for an underwriter resume depends on your level of experience and the complexity of your career history. Here are some general guidelines:

- Entry-level to mid-level underwriters (0-5 years of experience): Aim for a one-page resume. Focus on your education, internships, and early career achievements.

- Experienced underwriters (5-10 years of experience): A one to two-page resume is appropriate. Highlight your career progression, key achievements, and specialized expertise.

- Senior-level underwriters (10+ years of experience): Two pages are generally acceptable. Include a comprehensive overview of your career highlights, leadership roles, and significant contributions to the field.

Regardless of length, ensure that every piece of information on your resume is relevant and adds value to your application. Be concise and prioritize your most impressive and recent accomplishments.

What's the Best Format for an Underwriter Resume?

The best format for an underwriter resume is typically the reverse-chronological format. This structure is preferred by most employers and applicant tracking systems because it clearly showcases your career progression and most recent experiences. Here's why it works well for underwriters:

- It highlights your most recent and relevant experience first.

- It allows you to showcase your career growth and increasing responsibilities.

- It's easy for hiring managers to quickly assess your qualifications.

- It's the most familiar format for recruiters and ATS systems.

However, in some cases, a combination or functional resume format might be more appropriate:

- Combination format: Useful if you're transitioning from a different field into underwriting and want to highlight transferable skills alongside your work history.

- Functional format: Might be beneficial if you have significant gaps in your employment history or are making a major career change.

Regardless of the format you choose, ensure your resume is well-organized, easy to read, and highlights your most relevant qualifications for the underwriting position you're seeking.

What Should the Focus of an Underwriter Resume Be?

The focus of an underwriter resume should be on demonstrating your ability to assess risk, make informed decisions, and contribute to the profitability of the organization. Key areas to emphasize include:

- Risk Assessment Skills: Highlight your ability to evaluate complex risks across various industries or insurance lines.

- Analytical Abilities: Showcase your proficiency in analyzing financial data, market trends, and other relevant information.

- Industry Knowledge: Demonstrate your understanding of specific underwriting fields (e.g., property & casualty, life & health, mortgage) and relevant regulations.

- Technical Proficiency: Emphasize your skills with underwriting software, data analysis tools, and industry-specific technologies.

- Decision-Making: Illustrate your capacity to make sound underwriting decisions based on thorough analysis and judgment.

- Achievements: Quantify your contributions to portfolio performance, process improvements, or innovative underwriting approaches.

- Continuous Learning: Show your commitment to staying current with industry trends, new risks, and evolving underwriting practices.

- Collaboration: Highlight your ability to work effectively with other departments, such as sales, claims, and actuarial teams.

- Communication Skills: Emphasize your proficiency in explaining complex underwriting decisions to both internal and external stakeholders.

- Ethical Standards: Demonstrate your commitment to maintaining high ethical standards and regulatory compliance in underwriting practices.

By focusing on these key areas, you'll create a resume that effectively communicates your value as an underwriter and aligns with the priorities of potential employers in the insurance and financial services industries.

Conclusion

Crafting an effective underwriter resume requires a thoughtful approach that showcases your technical expertise, analytical skills, and industry knowledge. By following the guidelines and examples in this comprehensive guide, you'll be well-equipped to create a compelling resume highlighting your unique qualifications and achievements in the underwriting field. Remember to tailor your resume to each specific role, quantify your accomplishments, and demonstrate your value to potential employers. With a well-crafted resume, you'll be one step closer to landing your ideal underwriting position and advancing your career in this dynamic and rewarding field.

To further enhance your job search success, consider signing up for Huntr, a powerful tool designed to help you organize and optimize your job application process.

Get More Interviews, Faster

Huntr streamlines your job search. Instantly craft tailored resumes and cover letters, fill out application forms with a single click, effortlessly keep your job hunt organized, and much more...

AI Resume Builder

Beautiful, perfectly job-tailored resumes designed to make you stand out, built 10x faster with the power of AI.

Next-Generation Job Tailored Resumes

Huntr provides the most advanced job <> resume matching system in the world. Helping you match not only keywords, but responsibilities and qualifications from a job, into your resume.

Job Keyword Extractor + Resume AI Integration

Huntr extracts keywords from job descriptions and helps you integrate them into your resume using the power of AI.

Application Autofill

Save hours of mindless form filling. Use our chrome extension to fill application forms with a single click.

Job Tracker

Move beyond basic, bare-bones job trackers. Elevate your search with Huntr's all-in-one, feature-rich management platform.

AI Cover Letters

Perfectly tailored cover letters, in seconds! Our cover letter generator blends your unique background with the job's specific requirements, resulting in unique, standout cover letters.

Resume Checker

Huntr checks your resume for spelling, length, impactful use of metrics, repetition and more, ensuring your resume gets noticed by employers.

Gorgeous Resume Templates

Stand out with one of 7 designer-grade templates. Whether you're a creative spirit or a corporate professional, our range of templates caters to every career aspiration.

Personal Job Search CRM

The ultimate companion for managing your professional job-search contacts and organizing your job search outreach.